Fast, Affordable Landlord Insurance

Coverage for fires, windstorms, water leaks, vandalism, and more for your rental.

Coverage for fires, windstorms, water leaks, vandalism, and more for your rental.

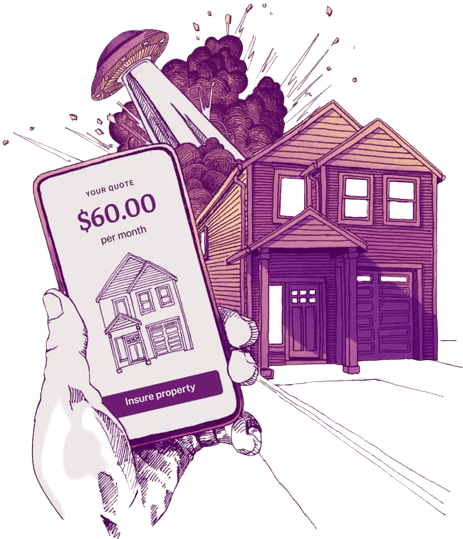

Instant Landlord Insurance Quote

Are you a rental property investor looking to protect your investments against damage and yourself against liability? Then you've come to the right place. Our rental property insurance policies are designed to offer all-inclusive coverage for your valuable investment assets in order to provide you with the necessary peace of mind. With our landlord insurance, you benefit from:

Comprehensive Coverage

Our rental property insurance provides coverage in case of fires, water, windstorms, hail, lightnings, riots, vandalism, theft, injuries, lawsuits, and more. We protect your investment property, your personal property, your tenants, and you.Affordable Rates

Our comprehensive landlord coverages are available at competitive costs. We offer affordable rates by customizing your landlord insurance policy to include your exact property type and only those landlord coverages you need. This helps you minimize operational costs and boost cash flow.Customizable Plans

Our landlord insurance policy is fully customizable to meet the exact needs of your rental properties and you. Whether you own single-family homes, condos, or multi family homes, whether you lease on a short term or long term basis, we will tailor our rental property insurance policies to suit your specific property and circumstances.Risk Mitigation

Owning traditional and vacation rental properties carries inherent risks. With our landlord policy, you can mitigate all foreseeable and unique risks and prevent financial setbacks in case of unexpected events such as natural disasters, vandalism, and theft.Instant Landlord Insurance Quotes

Just tells us a bit about your property, and one of our insurance agents will immediately get in touch with you with a customized quote. Then, you can discuss how to tailor what your landlord insurance covers based on your unique property and needs. There is no need to pay for property or liability coverage that you simply don't need.24/7 Customer Service

Our experienced insurance agent team is available to assist you throughout the insurance process. From obtaining a quote to filing a claim, we are here to provide best-in-class customer support. You don't need to be alone in challenging situations affecting your rental property business and you.

Full Rental Property Insurance Coverage

When choosing the best rental property insurance, you have to understand what exactly is included in the landlord coverage. Here is what you get with our landlord insurance policies:

Property Damage and Loss

Our rental property insurance safeguards your investment by providing financial protection against property damage caused by various risks including fires, water leaks, storms, vandalism, theft, and more.Personal Property Coverage

Our landlord insurance coverage includes damage to furnishings and other personal belongings present on the property during covered events.Personal Liability Protection

Our rental insurance liability coverage protects you from legal and medical costs in the event of bodily injuries sustained by tenants or their guests on your rental properties and consequent lawsuits.Loss of Rental Income

Our landlord policy covers lost rent payments at fair rental value during necessary repairs in case your rental property becomes uninhabitable due to a covered event.Additional Structures

Our rental property insurance coverage extends to external structures such as garages and sheds in order to guarantee that you and your property are protected against all perils.Optional Add-Ons

Our landlord insurance policy can be tailored to your specific needs with additional coverage for items like personal property, burglary, vandalism, and more. Request a quote today, and our qualified insurance agent will get in touch to provide you with the peace of mind and financial security you need.

Short Term Rental Landlord Insurance

Airbnb insurance, or vacation rental home insurance, is a special type of rental property insurance tailored to the needs and specifications of properties rented out on a short term basis on platforms like Airbnb and Vrbo.

While this specialized landlord insurance is not obligatory, it is essential in order to protect your vacation home, your belongings, your guests, and yourself against various hazardous situations and avoid unnecessary expenses.

Insurance for short term rentals secures your property, its belongings, additional structures, your Airbnb guests, their guests, and you as a host providing property damage and liability coverage including medical payments. Moreover, the best insurance companies offer covered loss of rent for as long as your property remains unrentable.

Whether you lease your primary residence, an investment apartment, or a cozy cabin, you need to protect your property against the risks not included in a standard homeowner's insurance policy. Request a personalized insurance quote today to make your Airbnb hosting experience hassle-free.