Is investing in Airbnb Boston worth your while? Read on to find out.

Table of Contents

- Why Is Boston MA a Great Airbnb Investment Location?

- How Does One Get an Airbnb Business Started in Boston?

- Wrapping It Up

Boston, the capital of Massachusetts, covers about 89.2 square miles. Although Beantown only occupies less than 1% of Massachusetts, almost 10% of the state’s population resides in the city. With a population of 693,417, Boston is one of the most populous cities in the US today.

Why Is Boston MA a Great Airbnb Investment Location?

Beantown is a great place for real estate investors, in general.

When it comes to Airbnb in Boston, investors might want to give it some serious thought. Airbnb Boston comes with pros and cons, with the latter usually relating to legal issues. But overall, Airbnb Boston MA is a pretty good business investment as long as you do it right.

Before the pandemic, the city attracted around 22.7 million tourists annually, with roughly 2.9 million coming from abroad. As COVID-19 restrictions are eased and lifted, Boston’s tourism is picking up and gaining momentum. The number of visitors coming in makes investing in Boston MA Airbnb a very lucrative business venture.

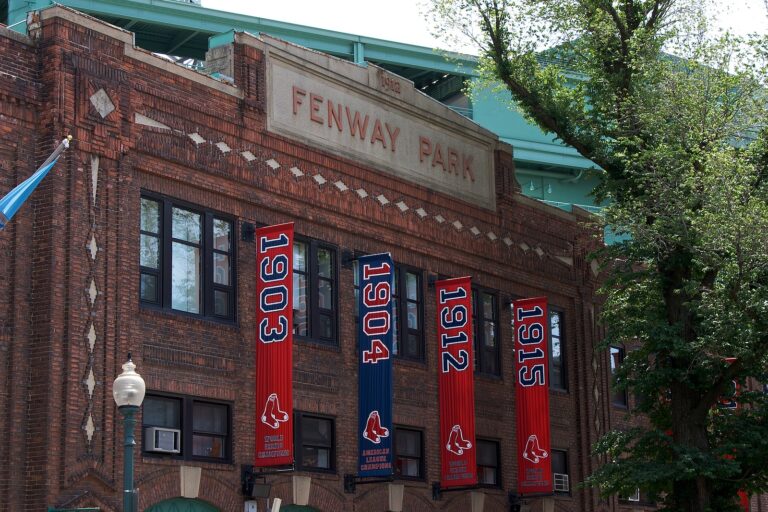

The city is known for the Boston Marathon, Fenway Park, and its world-famous baked beans. It boasts a thriving economy made up of tourism, financial services, technology, and venture capital. The industries play important roles in keeping Boston in the top ten US cities with the largest economy.

Boston MA is also home to a few top colleges and universities, such as Boston University and the University of Massachusetts. Additionally, it is also near Harvard and MIT in Cambridge MA.

Together, the above factors contribute to the steady increase in the number of residents, in-migrants, and tourists. As a result, the demand for both traditional and vacation rentals Boston MA continues to grow. Even Airbnb near Boston is prospering because of the influx of people and visitors to Beantown annually.

What Are the Numbers for Airbnb Boston?

Boston is an expensive place to buy investment properties. Despite this, investors still want to get an Airbnb business started in the Greater Boston area. We still recommend that folks who are considering investing in Boston Airbnb properties take a look at the numbers first.

Boston, MA

- Median Property Price: $897,116

- Average Price per Square Foot: $833

- Days on Market: 127

- Monthly Airbnb Rental Income: $4,105

- Airbnb Cash on Cash Return: 1.80%

- Airbnb Cap Rate: 1.82%

- Airbnb Daily Rate: $199

- Airbnb Occupancy Rate: 62%

- Walk Score: 84

As you can see, half of Boston’s properties come with a very hefty price tag. We’re pretty sure you will still find reasonably priced listings but it’s better to manage your expectations. For this reason, any serious investor will need to perform extensive research about the market. More than the general Boston real estate market, we recommend zooming in on its different neighborhoods.

Knowing which neighborhoods are performing well based on the latest Airbnb data will give you the upper hand over the competition. To do so, a proper rental market analysis is in order. Being able to access a database with relevant information will help you make smarter investment choices.

One thing to also include in your research is real estate comps and rental comps. The two will help you determine if a property is worth investing in or not based on comparable properties.

Boston Summertime Trends to Watch Out For

As with most predictions for the US housing market, property prices and mortgage rates in Boston will continue increasing. Following this spring’s momentum, the summertime housing market in Boston is expected to remain hot.

Experts and industry analysts expect that despite historical lows, interest rates will hit 5% by 2022’s end. We’ve gone past that mark back in April due to unforeseeable circumstances. However, the rates slowed their increase between May 2022 and the start of June. While mortgage rates are hovering around the 5% mark, they are still expected to continue going up for the remainder of 2022.

As far as short-term rentals are concerned, summertime is also one of the peak seasons for Airbnb Boston. Given that its tourism industry is one of the top contributors to the local economy, rental property owners can expect more visitors to come in during the summer. Students from Harvard and MIT looking for a quick adventure would often go to Boston. People looking to experience Beantown’s culture and attractions also flock to the city.

All of the above make summertime a very good season for Airbnb owners and hosts to increase their profit. The more experienced and wiser Airbnb hosts and owners know to take advantage of the current season. Nightly rates are reasonably adjusted on a vacation rental by owner Boston MA to raise their seasonal income. Other more resourceful hosts add other services, like food preparation or guided tours, to boost their Airbnb income. With all the different activities that the Cradle of Liberty can offer in the summer, such a move makes total sense.

So generally, the short-term rental scene in Boston is expected to pick up significantly over the next few months.

Related: Here’s the Real Estate Forecast for the Next 5 Years

How Does One Get an Airbnb Business Started in Boston?

Now just because the short-term rental scene is expected to be hot this summer doesn’t mean that things will go smoothly for aspiring Airbnb hosts. Regulations are quite strict in Massachusetts where short-term rentals are concerned. Boston vacation rentals, in particular, are highly regulated, just like in Cambridge. Those who are interested in Airbnb Boston Massachusetts should carefully study the legislation surrounding them to avoid illegal Airbnb operations.

Boston Airbnb Policies and Regulations

The city’s successfully put in place certain policies and regulations on vacation rentals to protect the interest of the local communities. For one to become eligible for Airbnb hosting in Boston, the following requirements must be met:

- The property must be classified as residential use;

- The property should not be restricted by affordability covenants and lease terms;

- The property must comply with the local housing code, including proper garbage disposal and noise regulation; and

- The owner must reside on the property or in the adjacent property next to the vacation rental property.

If all of the above conditions are met, a license must also be obtained to legally run an Airbnb business in Boston.

Starting an Airbnb Business in Boston

Once all of the eligibility requirements are met, a prospective owner must then secure a license from the government. The license will allow the owner to run and manage a vacation rental business legally.

To secure a license, the property owner must:

- Show some proof of primary residence

- Obtain a business certificate

- Place visible signs in the unit where fire extinguishers, fire alarms, and emergency exits are located

- Pay the respective fees for operating a short-term rental property. The fees include a $25 application fee for Limited Share units or $200 for Home Share and Owner Adjacent units.

However, before securing all the legal documents needed to operate an Airbnb property, real estate investors should also choose the right income property in the right neighborhood. Location matters in this game. Finding the right location and property will entail conducting due diligence faithfully.

To find the right property, you will first need to assess the overall market. Then, you need to look for the most profitable neighborhoods within that market. Once you’re done, you can now narrow down your choices using rental comps. However, doing such a thing the traditional way will take weeks to months of hard work.

Fortunately, technology’s significantly sped up the process. What used to take months to do research can now be done in minutes with real estate websites like Mashvisor.

To learn more about how Mashvisor can help you find profitable investment properties, schedule a demo now.

The Top 5 Boston Locations Ideal for an Airbnb Business

There are a lot of great places to start an Airbnb business in Beantown. Airbnb Boston Downtown is especially popular, as well as Airbnb Boston Back Bay. However, investors aren’t always looking for popularity. What they’re really after is profitability.

Data from the real estate website Mashvisor was used to come up with this list of profitable neighborhoods for Airbnb Boston. The list is ranked based on cash on cash return rates. We chose to go with the said metric as it is quite similar to a cap rate formula but it factors in the actual cash investment in its computation.

Let’s take a look at the neighborhood numbers:

1. South Dorchester

- Median Property Price: $561,463

- Average Price per Square Foot: $438

- Days on Market: 75

- Monthly Airbnb Rental Income: $3,918

- Airbnb Cash on Cash Return: 3.57%

- Airbnb Cap Rate: 3.63%

- Airbnb Daily Rate: $166

- Airbnb Occupancy Rate: 64%

- Walk Score: 81

One of the main reasons why South Dorchester is an excellent place to invest in is its housing stock. The neighborhood is home to a relatively large inventory with plenty of variation to go around. Compared to other neighborhoods, properties in South Dorchester are reasonably priced.

2. Beacon Hill

- Median Property Price: $549,000

- Average Price per Square Foot: $1,032

- Days on Market: 1,192

- Monthly Airbnb Rental Income: $3,983

- Airbnb Cash on Cash Return: 3.41%

- Airbnb Cap Rate: 3.46%

- Airbnb Daily Rate: $187

- Airbnb Occupancy Rate: 63%

- Walk Score: 99

Beacon Hill is one of Boston’s most charming neighborhoods with its highly Instagrammable aesthetic. But more than being just a visual treasure, Beacon Hill offers a very good cash on cash return rate on very affordable housing in Beantown. It makes the neighborhood a very good Airbnb business location.

3. Allston

- Median Property Price: $664,000

- Average Price per Square Foot: $504

- Days on Market: 48

- Monthly Airbnb Rental Income: $4,569

- Airbnb Cash on Cash Return: 3.28%

- Airbnb Cap Rate: 3.33%

- Airbnb Daily Rate: $199

- Airbnb Occupancy Rate: 67%

- Walk Score: 83

Known as Little Cambridge, Allston boasts one of the highest cash on cash return and occupancy rates in the city. The median property value may be a bit higher for most people, but the 3.28% cash on cash return and 3.33% cap rate will get you a good return on investment.

4. Brighton

- Median Property Price: $526,800

- Average Price per Square Foot: $590

- Days on Market: 76

- Monthly Airbnb Rental Income: $3,570

- Airbnb Cash on Cash Return: 2.94%

- Airbnb Cap Rate: 2.99%

- Airbnb Daily Rate: $164

- Airbnb Occupancy Rate: 66%

- Walk Score: 93

Brighton is known to be one of Boston’s safest neighborhoods. That alone can generate huge interest from both potential long-term and short-term tenants. Brighton’s safety seal, plus very decent cash on cash return and cap rate, makes investing in the neighborhood a good move.

5. Fenway

- Median Property Price: $625,000

- Average Price per Square Foot: $934

- Days on Market: 43

- Monthly Airbnb Rental Income: $3,957

- Airbnb Cash on Cash Return: 2.48%

- Airbnb Cap Rate: 2.51%

- Airbnb Daily Rate: $191

- Airbnb Occupancy Rate: 62%

- Walk Score: 93

Given that Fenway Park is one of Boston’s top attractions, owning an Airbnb near Fenway Park makes a lot of sense. The numbers for Fenway aren’t bad either. The neighborhood shows an above-average occupancy rate of 62% and a good cash on cash return rate of 2.48%. Investors won’t go wrong investing in a rental property in Fenway.

Owning an Airbnb near Fenway Park makes a lot of sense, with the stadium attracting tens of thousands of sports fans every game day.

Wrapping It Up

Investing in Airbnb Boston can be quite rewarding when done right. It is a very progressive city with a thriving economy. As one of the densely populated and most visited cities in the country, the demand for rental property will remain high. It makes investing in Boston a very sound strategy for real estate investors, both local and from out-of-state.

However, don’t just take our word for it. Do your homework. Find as much information as you can about the Boston real estate market so you can make an informed decision. It helps to obtain the relevant market data and the right investing tools to do the job. Mashvisor can be very useful here, with countless users and subscribers attesting to it.

To find the latest real estate market data on Boston MA, sign up for a week-long trial of Mashvisor today, followed by 15% off for life.