Using an Airbnb rental income calculator is now common among beginner real estate investors. That’s why it’s important to learn how to use one.

It is well known that the biggest challenge beginner investors face is gathering large amounts of real estate data and calculating the potential earnings of each property.

This process has historically been the most cumbersome and time-consuming when investing in rental property. With the rise of short-term rentals on Airbnb as a popular type of investment, analyzing Airbnb properties has only become harder.

Luckily, in recent years, a number of valuable tools have emerged to help investors overcome these challenges.

Mashvisor’s Airbnb rental income calculator is one of the tools that every beginner investor should consider using, and in this article, we’re going to tell you why.

But before we get into that, we will first take a look at the Airbnb market in 2023 to see if it makes sense to invest in short-term rentals this year.

Afterward, we will talk about the process of calculating the potential income of an Airbnb property and all the different things that you need to consider.

Ultimately, you will learn what an Airbnb income calculator is, why you need to use it, and how Mashvisor’s tool is simply the best tool you can find on the market.

How Much Can You Make on Airbnb in 2023?

The amount of money you can make on Airbnb in 2023 will depend on the location of your Airbnb property and the current situation of the rental market.

Generally speaking, Airbnb rental prices are affected by the season, local events and festivities, tourist attractions, occupancy rate, and amenities.

All the above factors will determine how much revenue you can generate from your Airbnb rental.

Locations with a thriving tourism industry and high demand for short-term rentals will be more profitable for Airbnb investors.

In addition, if you can secure a competitive price for a well-furnished and well-located rental property, it can potentially lead to substantial profits.

Finally, having a good knowledge of the local rental market can help you identify the expected return on investment of your property and make the best Airbnb investment decision.

What Determines a Good Market for an Airbnb Rental in 2023?

To understand what makes a good market for an Airbnb rental, you must look at tourism and travel trends in the market you want to invest in.

Since most of the people who will be renting your property are only staying for a short duration, they will want to make the most out of their stay.

Therefore, the most important thing to take into consideration for an Airbnb rental is its location and how easy it is to get to the main activities in that area from that location.

If you’re investing in a city or a small town, your Airbnb market research should focus on indicators, such as:

- How many tourists and travelers come to the area each year, on average?

- What times of the year do most travelers come (what seasons or months)?

- How long do they typically stay?

- What are the most common types of activities that they engage in?

- What annual or seasonal events take place that attract tourists and travelers?

Looking at the above indicators, it becomes easy to understand what you’re looking for in the most popular Airbnb locations to invest in and how you can turn it into a profit.

Of course, while the said indicators can tell you a lot about the demand for Airbnb rentals in the area, they don’t let you know how profitable short-term rentals are.

It is why every investor needs to use an Airbnb rental income calculator to calculate their potential returns and determine whether it’s a good investment or not.

How to Calculate Your Potential Airbnb Income

Calculating your potential Airbnb income requires taking into account the maintenance costs and other relevant expenses, taxes, and Airbnb occupancy rate. However, it can be cumbersome if done manually.

On the other hand, Airbnb rental income calculators can make the process easier and faster. An Airbnb calculator can help you evaluate the estimated rental income of a particular property once the required data is entered.

Before investing in a rental property, one must consider all expenses while making sure the potential rental income is enough to cover the expenses.

The main expenses that investors must always take into consideration include the following:

- Taxes

- Insurance

- Monthly mortgage payments

- Utilities

Furthermore, if you’re taking out a loan, make sure to double-check the loan terms, interest rate, and payment plan to avoid any surprises.

Once you gather enough data about the above expenses and calculate the average rental income that you’re expecting to make, it’s time to calculate the ROI metrics.

What Metrics Measure the ROI of an Airbnb Rental?

There are two main metrics that most Airbnb investment calculators use to measure the potential return on investment from an Airbnb rental.

The two metrics are:

- Capitalization rate (or cap rate)

- Cash on cash return (or CoC)

Both metrics are often used in Airbnb rental income calculators and tools, so it is important to be familiar with them and what they mean.

The cap rate metric is used to measure the return on investment based on the Airbnb investment property’s net income compared to its current market value.

It means that regardless of how much you actually pay for the property, the cap rate helps determine its ROI based on what you can sell it for in the current market.

The cash-on-cash return, on the other hand, measures the ROI based on the actual cash you’ve invested in it, disregarding any borrowed money through a loan or mortgage.

So, if you’re financing 80% of the property’s price using borrowed money, only the 20% that you’re paying out of your pocket will be considered by the CoC metric.

Of course, both metrics should include as much information as possible in terms of the monthly and annual expenses, as well as any additional sources of income the property presents.

Obviously, it can be very cumbersome to do all the calculations by hand for each property you’re considering. It is why it’s always recommended to use an Airbnb rental income calculator.

With the help of a rental income calculator, you can easily estimate the amount of revenue your rental property will generate on a monthly basis and decide whether it is a wise investment.

What Is an Airbnb Income Calculator?

An Airbnb rental income calculator is a tool that estimates how much money you can make from a rental property or Airbnb listing.

The calculator will consider the cost of your property and its monthly expenses, such as taxes, insurance, bills, and Airbnb occupancy rate, to determine the estimated rental income.

The best Airbnb rental income calculators will be able to provide you with additional real estate statistics, such as:

- Airbnb cash on cash return

- Airbnb cap rate

- Airbnb rental comps

- Airbnb rental prices

The above data can be valuable in the decision-making process when it comes to investing in an Airbnb property.

The cap rate and cash-on-cash return metrics are particularly useful for investors as they are the main indicators of the property’s long-term return on investment.

Platforms like Mashvisor use the said metrics to help buyers find properties by providing them with the right filters and tools during their search.

Mashvisor’s Airbnb Rental Income Calculator

How Does Mashvisor’s Airbnb Rental Income Calculator Work?

Mashvisor’s rental income calculator is one of the most advanced Airbnb rental income calculators available in the market today.

To use our rental income calculator, all you need to do is enter the location you’re interested in. Then, you will be presented with a list of rental properties currently listed on the market.

You can also filter the results by customizing the number of bedrooms and bathrooms, HOA fees, annual taxes, and maximum price.

Once you find the rental property or listing you’re interested in, you can view the property’s estimated rental income by clicking on “Rental Income” in the property profile. It will give you an accurate estimate of how much money you can make from the rental property.

In addition to the estimated rental income, you can get other real estate metrics, such as Airbnb cash on cash return, cap rate, and rental comps.

To get access to our real estate investment tools, sign up for Mashvisor today.

Where Does Mashvisor’s Data Come From?

Mashvisor’s Airbnb rental income calculator gathers data from multiple trusted and high-quality sources. The two main sources of data that the tool utilizes are Airbnb and the MLS.

It allows Mashvisor to gather a diverse and big amount of Airbnb data that can then be used by our machine learning algorithm to provide results and insights.

The data gathered includes the following:

- Historical property prices

- Up-to-date market prices

- Historical rental rates (Monthly and daily rates)

- Estimated expenses, including utilities, taxes, insurance, and property maintenance

- Airbnb occupancy data

- Ownership and contact information

- All property characteristics (Type, size, number of rooms, age)

- Property status (Listed for sale, foreclosed, off-market)

In addition to Airbnb and the MLS, Mashvisor gathers data from other sources, such as private realtors and agents. It provides Mashvisor with access to plenty of off-market properties you won’t find in other sources, which can sometimes present great opportunities for investing.

All of the above data are fed into the Airbnb rental income calculator, which is designed to let you customize and modify the values to suit your Airbnb investment analysis.

Customizable Rental Income Calculator

One of the best features of Mashvisor’s Airbnb rental income calculator is that you can customize and adjust the values to suit your criteria and preferred strategy.

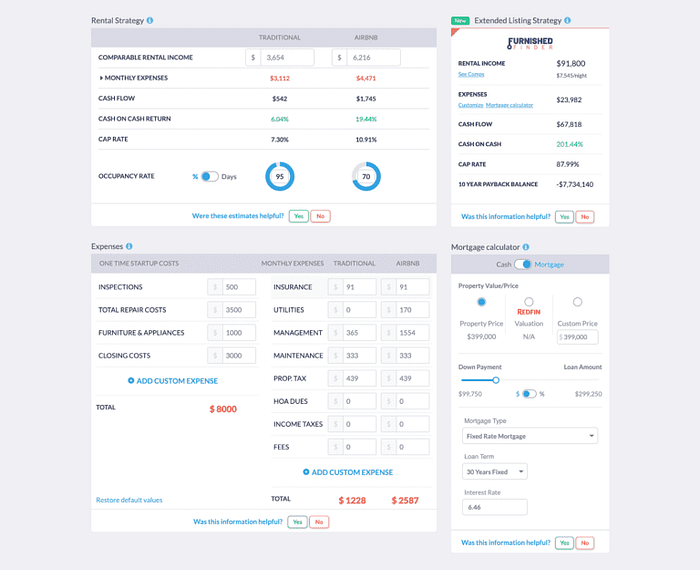

Starting with the main part of the calculator, you will see the main metrics and information that you want to know about the property, including the following:

- Monthly rental estimate

- Daily rental income

- Occupancy rate

- Property price

- Airbnb and long-term cap rate

- Airbnb and long-term cash on cash return

The results that you see are based on the values in the other parts of the calculator.

Firstly, the expenses section includes all one-time costs and monthly recurring expenses of owning the property. They include all the expenses that anyone would think of, such as utilities, taxes, and insurance.

You can modify or remove any value in this section, and you can also add new ones if you think the property will have additional unique expenses.

The values you see by default are based on the gathered data and the market’s averages.

The second customizable section of the tool is the mortgage calculator. It is what you would expect from a mortgage calculator, and it lets you choose the type of mortgage, its duration, interest rate, and amount.

The results section of the tool will directly reflect all changes and selections you make in both sections.

Finally, the Airbnb rental income calculator also provides you with rental comps to see how each property compares to other similar properties around it in terms of its estimated returns.

Final Thoughts: Maximize Your Airbnb Earnings

In conclusion, calculating Airbnb rental incomes can help you make better investment decisions and maximize your potential Airbnb earnings.

Strategic real estate investments based on estimated rental incomes can help you achieve higher returns and a better track record.

A good Airbnb rental income calculator will take into account various factors and provide you with sound real estate investment advice that can maximize your profits.

Mashvisor’s rental income calculator is a powerful tool that turns real estate investing into simple math.

With features such as rental comps, a cap rate calculator, and rental income estimates, Mashvisor provides an all-in-one solution to help you make informed real estate investment decisions.

Try it out today and see what returns you can get on your rental property investments.

Ready for a demo of Mashvisor’s capabilities? Schedule a demo now for a quick session with one of our representatives.