Real estate investing is a great way to make money, but in order to be a successful real estate investor, you need to buy an investment property in the best locations. Location is key to determining your profitability and return on investment. This is especially true if you’re investing and making money through Airbnb rental income!

If you’re looking for an Airbnb investment property in the US housing market, then you’re definitely wondering which top cities across the country have a high Airbnb rental income. After all, the Airbnb rental income is what determines the profits real estate investors make from Airbnb investment properties.

Some cities across the US housing market are great locations for an Airbnb investment property and yield an Airbnb rental income much higher than a traditional rental income. Other cities, on the other hand, are better suited for a traditional real estate investment property. Why so? Because the Airbnb rental income real estate investors can expect is determined by a number of factors such as location, occupancy rate, and property management.

Head over to Mashvisor’s knowledge center for more information regarding anything related to real estate investing!

In this article, we first explain how these three factors affect your Airbnb rental income. Moreover, we list the top 10 cities across the US housing market in which real estate investors will receive the highest Airbnb rental income (as computed by Mashvisor’s rental property calculator) in addition to other data such as the median property price, occupancy rate and Airbnb cap rate and cash on cash return.

What Determines Your Airbnb Rental Income?

The Location of the Investment Property

As mentioned, the location of an investment property (whether traditional or Airbnb) is key to determining its profitability. As a result, location is the first thing that real estate investors should take into consideration before buying an investment property. Thus, to get the highest Airbnb rental income, you have to invest in a location that matches this investment strategy.

Typically, the best locations to buy an Airbnb investment property are those that attract a high number of tourists – these locations have a high demand for Airbnb rentals, meaning high Airbnb rental income. In addition, don’t forget to look for locations in which Airbnb is legal!

Mashvisor’s platform provides property investors with analytics for each area or neighborhood, allowing them to know whether a certain location is good for an Airbnb investment property quickly and without a hassle.

To start looking for and analyzing the best investment properties in your city and neighborhood of choice, click here.

Occupancy Rate

When it comes to Airbnb rental income, it is necessary to take into consideration the investment property’s occupancy rate – the amount of time during a year that it is occupied by a tenant. This rate depends on many factors, mainly the location of the investment property, but also by how the real estate investor advertises his/her property and Airbnb reviews.

For example, an Airbnb investment property that has a high number of positive ratings and reviews will typically be in higher demand and have a much higher occupancy rate. As a result, this leads to a higher Airbnb rental income!

Property Management

How you manage your Airbnb investment property can drastically increase or decrease your Airbnb rental income! In general, managing short-term rentals requires a lot of time and effort due to the high frequency of tenant turnover. For this reason, some property investors turn to hiring a professional property management company and make use of their services when investing in Airbnb rentals.

However, if you’re looking for a high Airbnb rental income, you should keep in mind that property management companies come with a price. Most professional property management companies charge real estate investors 8-12% of their property’s rental rate, which will definitely impact your expected Airbnb rental income and profit margin.

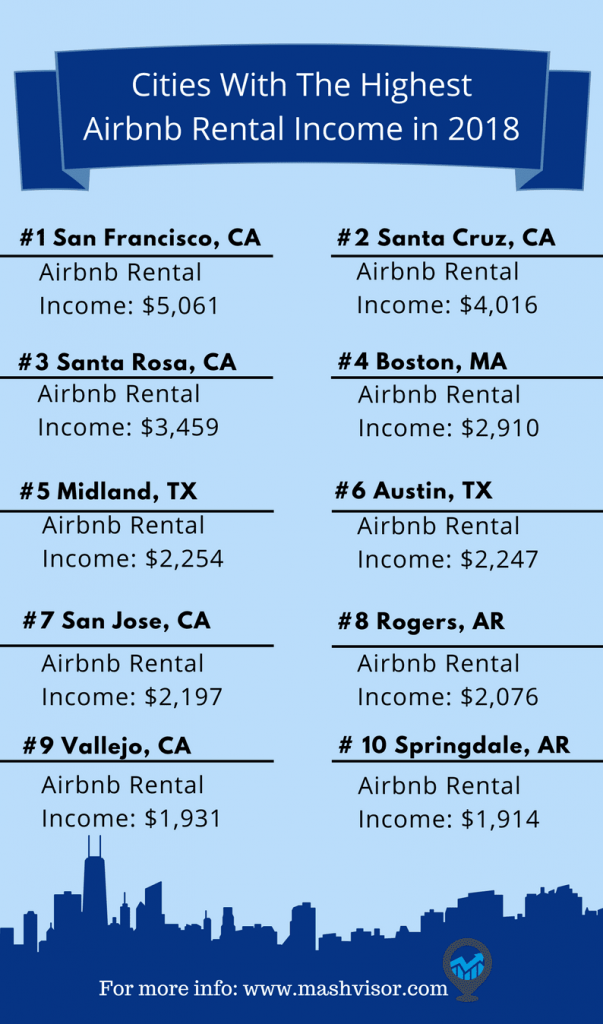

Top 10 Cities With the Highest Airbnb Rental Income in 2018

As you can see, the California real estate market is clearly dominating the ranking with 5 out of these 10 cities located in the state of California!

To start looking for and analyzing the best investment properties in your city and neighborhood of choice, click here.

Besides Airbnb rental income, here is further Airbnb data and information that real estate investors should know before buying an investment property as an Airbnb rental in these cities. These numbers are provided to you by Mashvisor’s rental property calculator – the ultimate real estate investing tool which uses traditional as well as predictive analytics to provide you with reliable estimates for both traditional rentals and Airbnb rentals.

San Francisco, CA Real Estate Market

- Median Property Price: $1,455,451

- Airbnb Rental Income: $5,061

- Airbnb Cash on Cash Return: 1.82%

- Airbnb Cap Rate: 1.82%

- Airbnb Occupancy Rate: 69.45%

Santa Cruz, CA Real Estate Market

- Median Property Price: $817,000

- Airbnb Rental Income: $4,016

- Airbnb Cash on Cash Return: 2.57%

- Airbnb Cap Rate: 2.57%

- Airbnb Occupancy Rate: 57.20%

Santa Rosa, CA Real Estate Market

- Median Property Price: $626,950

- Airbnb Rental Income: $3,459

- Airbnb Cash on Cash Return: 3.74%

- Airbnb Cap Rate: 3.74%

- Airbnb Occupancy Rate: 56.83%

Boston, MA Real Estate Market

- Median Property Price: $820,398

- Airbnb Rental Income: $2,910

- Airbnb Cash on Cash Return: 1%

- Airbnb Cap Rate: 1%

- Airbnb Occupancy Rate: 57.17%

Midland, TX Real Estate Market

- Median Property Price: $350,000

- Airbnb Rental Income: $2,254

- Airbnb Cash on Cash Return: 2.33%

- Airbnb Cap Rate: 2.33%

- Airbnb Occupancy Rate: 45.86%

Austin, TX Real Estate Market

- Median Property Price: $451,438

- Airbnb Rental Income: $2,247

- Airbnb Cash on Cash Return: 1.84%

- Airbnb Cap Rate: 1.84%

- Airbnb Occupancy Rate: 59.34%

San Jose, CA Real Estate Market

- Median Property Price: $966,204

- Airbnb Rental Income: $2,197

- Airbnb Cash on Cash Return: 0.65%

- Airbnb Cap Rate: 0.65%

- Airbnb Occupancy Rate: 46.21%

Rogers, AR Real Estate Market

- Median Property Price: $219,900

- Airbnb Rental Income: $2,076

- Airbnb Cash on Cash Return: 6.34%

- Airbnb Cap Rate: 6.34%

- Airbnb Occupancy Rate: 49.06%

Vallejo, CA Real Estate Market

- Median Property Price: $389,000

- Airbnb Rental Income: $1,931

- Airbnb Cash on Cash Return: 2.72%

- Airbnb Cap Rate: 2.72%

- Airbnb Occupancy Rate: 52.22%

Springdale, AR Real Estate Market

- Median Property Price: $187,000

- Airbnb Rental Income: $1,914

- Airbnb Cash on Cash Return: 5.89%

- Airbnb Cap Rate: 5.89%

- Airbnb Occupancy Rate: 31.63%

Click here to start looking for and analyzing different investment properties in any state, city, and neighborhood across the US housing market!

How to Find an Airbnb Rental in These Cities

Mashvisor’s platform provides property investors with the best real estate investing tools to make smart investment decisions for a successful real estate investing career. To find the best Airbnb investment properties with high Airbnb rental income in any state, city, and neighborhood across the US housing market, make use of Mashvisor’s:

- Investment Property Finder: A powerful and heavily customizable search tool that allows property investors to search for investment properties based on specific criteria, such as finding properties of a certain type, in a certain neighborhood, or with a certain Cap Rate.

- Investment Property Calculator: A versatile and customizable tool that allows property investors to calculate the different values related to a real estate investment property. The main values that you will be able to calculate are Cash on Cash Return, Cap Rate, Cash Flow, and Airbnb Occupancy Rate.

- Heat Map Function: The heat map function for the property finder tool allows property investors to find investment properties much faster using visual cues. For example, you can set the heat map to indicate the areas with the highest Cash on Cash Return, and you will immediately be able to tell which areas have the highest potential for high Cash on Cash Return properties.

Sign up with Mashvisor to get full access to these real estate investing tools and more to help you find the best Airbnb investment property with the highest Airbnb rental income!

Airbnb Rental Income – The Bottom Line

To conclude, real estate investing through Airbnb can be your way to riches and fortune as long as you invest in the best locations! Your Airbnb rental income depends on the location, occupancy rate, and management of your real estate investment property. The above-mentioned cities are those in which property investors will find investment properties with an expected high Airbnb rental income, as calculated by Mashvisor’s rental property calculator. To learn more about all aspects of real estate investing, continue reading our blog.

To start using Mashvisor, click here.