The Atlanta real estate market often makes it onto lists of the best places to buy rental property and 2020 is no different. Atlanta came in #8 in this list of the best places to invest in real estate this year. Here are a few reasons why:

- Atlanta, Georgia is home to a large population, one of the 50 largest in the United States. The Atlanta metro area is one of the 10 largest in the US.

- More importantly, the Atlanta housing market has a large renter population – 60% of residents live in an Atlanta rental property, according to NeighborhoodScout. This means high demand for long term rentals in the city.

- Atlanta’s economy is actually the 10th largest in the US and the 18th largest in the world, by GDP. The diverse economy supports the growth and prosperity of the local real estate market.

- The Atlanta real estate market 2020 is a cool buyer’s market according to Zillow. This means there is an opportunity to find great real estate deals in Atlanta now.

- The latest Atlanta housing market predictions forecast a small negative real estate appreciation of 1.5% However, for those looking for buy and hold rental properties, this could mean a slight price reduction on Atlanta homes for sale during this year.

- On average, Atlanta investment properties have appreciated by 2.85% every year since Q1 2000. So although local property values may drop initially, historical Atlanta real estate trends tell us that they will likely rise again in the future. That’s why a rental property investment strategy is best in this market as opposed to fixing and flipping houses.

- Both owner and non-owner occupied Airbnb Atlanta rental properties can operate legally thanks to lenient short-term rental regulations.

- Not only is Airbnb legal in Atlanta, but short-term rental properties are in high demand thanks to the thriving tourism industry. The city welcomes over 50 million visitors every year and is a very hot tourist destination.

- Atlanta real estate investments generate a good return on investment. Take a look at Mashvisor’s Atlanta real estate data:

- Median Property Price: $449,701

- Price per Square Foot: $270

- Price to Rent Ratio: 18

- Traditional Rental Income: $2,067

- Traditional Cash on Cash Return: 1.8%

- Average Airbnb Daily Rate: $159

- Airbnb Rental Income: $2,098

- Airbnb Cash on Cash Return: 1.1%

- Airbnb Occupancy Rate: 44%

Learn more by reading Mashvisor’s Atlanta real estate market forecast for 2020.

With a list of reasons like that, it’s no wonder why more and more people are becoming Atlanta real estate investors. In fact, from March 2020 to mid-May, Atlanta was the 3rd most searched city on Mashvisor’s platform, following the Los Angeles and Orlando real estate market. Investors have seen the positive Atlanta real estate market analysis and are hunting for deals (even during the coronavirus pandemic).

Where to Begin Your Property Search in the Atlanta Real Estate Market 2020

Although you may have chosen a great real estate market to invest in, your job is not done yet. You cannot just take a quick look at a list of Atlanta houses for sale in your budget and make an offer. The next step is to find a great neighborhood for buying rental properties. To save you the time of conducting your own neighborhood analysis, we’ve put together a list of the best Atlanta neighborhoods by property type. Here, you’ll find a great neighborhood whether you’re investing in Airbnb or a traditional multi family home for sale.

The Best Neighborhoods in Atlanta for Airbnb for Sale

#1. Orchard Knob

- Median Property Price: $144,821

- Price per Square Foot: $102

- Average Airbnb Daily Rate: $130

- Airbnb Rental Income: $2,506

- Airbnb Cash on Cash Return: 8.5%

- Airbnb Occupancy Rate: 56%

#2. Sandlewood Estates

- Median Property Price: $229,901

- Price per Square Foot: $108

- Average Airbnb Daily Rate: $137

- Airbnb Rental Income: $3,058

- Airbnb Cash on Cash Return: 6.7%

- Airbnb Occupancy Rate: 50%

#3. Midwest Cascade

- Median Property Price: $236,167

- Price per Square Foot: $107

- Average Airbnb Daily Rate: $113

- Airbnb Rental Income: $3,094

- Airbnb Cash on Cash Return: 5.9%

- Airbnb Occupancy Rate: 68%

#4. Dixie Hills

- Median Property Price: $135,193

- Price per Square Foot: $120

- Average Airbnb Daily Rate: $124

- Airbnb Rental Income: $1,773

- Airbnb Cash on Cash Return: 5.7%

- Airbnb Occupancy Rate: 44%

#5. Glenrose Heights

- Median Property Price: $201,167

- Price per Square Foot: $118

- Average Airbnb Daily Rate: $124

- Airbnb Rental Income: $2,151

- Airbnb Cash on Cash Return: 5.0%

- Airbnb Occupancy Rate: 51%

Find a profitable Airbnb rental property in the Atlanta real estate market now.

Related: How to Find Neighborhoods with a High Airbnb Occupancy Rate

The Best Neighborhoods in Atlanta for Long Term Rental Properties for Sale

Because single family homes for sale dominate the Atlanta housing market, the data here represents the best Atlanta neighborhoods for single family rentals as well. Also note that, on average, single family homes generate the highest cash on cash return when looking at the city-level data (2.5%).

#1. Hunter Hills

- Median Property Price: $233,213

- Price per Square Foot: $127

- Price to Rent Ratio: 12

- Traditional Rental Income: $1,664

- Traditional Cash on Cash Return: 4.1%

#2. West Lake

- Median Property Price: $201,223

- Price per Square Foot: $130

- Price to Rent Ratio: 11

- Traditional Rental Income: $1,504

- Traditional Cash on Cash Return: 3.6%

#3. Dixie Hills

- Median Property Price: $135,193

- Price per Square Foot: $120

- Price to Rent Ratio: 10

- Traditional Rental Income: $1,114

- Traditional Cash on Cash Return: 3.6%

#4. Princeton Lakes

- Median Property Price: $172,445

- Price per Square Foot: $93

- Price to Rent Ratio: 11

- Traditional Rental Income: $1,293

- Traditional Cash on Cash Return: 3.3%

#5. Orchard Knob

- Median Property Price: $144,821

- Price per Square Foot: $102

- Price to Rent Ratio: 10

- Traditional Rental Income: $1,217

- Traditional Cash on Cash Return: 3.2%

Find a profitable long term rental property in the Atlanta real estate market now.

The Best Neighborhoods in Atlanta for Condos for Sale

#1. Riverside

- Median Property Price: $282,361

- Price per Square Foot: $170

- Price to Rent Ratio: 11

- Traditional Rental Income: $2,076

- Traditional Cash on Cash Return: 2.7%

#2. East Chastain Park

- Median Property Price: $275,182

- Price per Square Foot: $218

- Price to Rent Ratio: 8

- Traditional Rental Income: $2,735

- Traditional Cash on Cash Return: 2.2%

#3. Pine Hills

- Median Property Price: $231,605

- Price per Square Foot: $209

- Price to Rent Ratio: 8

- Traditional Rental Income: $2,350

- Traditional Cash on Cash Return: 2.0%

#4. Ridgedale Park

- Median Property Price: $545,644

- Price per Square Foot: $343

- Price to Rent Ratio: 18

- Traditional Rental Income: $2,587

- Traditional Cash on Cash Return: 1.9%

#5. Brookhaven

- Median Property Price: $230,586

- Price per Square Foot: $192

- Price to Rent Ratio: 9

- Traditional Rental Income: $2,061

- Traditional Cash on Cash Return: 1.8%

Find a profitable condo for sale in the Atlanta real estate market now.

The Best Neighborhoods in Atlanta for Townhouses for Sale

#1. Princeton Lakes

- Median Property Price: $160,527

- Price per Square Foot: $92

- Price to Rent Ratio: 10

- Traditional Rental Income: $1,293

- Traditional Cash on Cash Return: 3.3%

#2. Lindridge – Martin Manor

- Median Property Price: $534,568

- Price per Square Foot: $202

- Price to Rent Ratio: 14

- Traditional Rental Income: $3,082

- Traditional Cash on Cash Return: 2.9%

#3. Riverside

- Median Property Price: $313,724

- Price per Square Foot: $136

- Price to Rent Ratio: 13

- Traditional Rental Income: $2,076

- Traditional Cash on Cash Return: 2.7%

#4. Hapeville

- Median Property Price: $149,344

- Price per Square Foot: $87

- Price to Rent Ratio: 10

- Traditional Rental Income: $1,234

- Traditional Cash on Cash Return: 2.5%

#5. Ben Hill

- Median Property Price: $175,631

- Price per Square Foot: $118

- Price to Rent Ratio: 11

- Traditional Rental Income: $1,340

- Traditional Cash on Cash Return: 2.5%

Find a profitable townhouse for sale in the Atlanta real estate market now.

The Best Neighborhoods in Atlanta for Multi Family Homes for Sale

#1. Grove Park

- Median Property Price: $115,000

- Price to Rent Ratio: 5

- Traditional Rental Income: $2,061

- Traditional Cash on Cash Return: 5.3%

#2. Dixie Hills

- Median Property Price: $175,000

- Price to Rent Ratio: 13

- Traditional Rental Income: $1,114

- Traditional Cash on Cash Return: 3.6%

#3. West View

- Median Property Price: $247,800

- Price to Rent Ratio: 11

- Traditional Rental Income: $1,922

- Traditional Cash on Cash Return: 3.6%

#4. Princeton Lakes

- Median Property Price: $240,000

- Price to Rent Ratio: 16

- Traditional Rental Income: $1,293

- Traditional Cash on Cash Return: 3.3%

#5. Bankhead

- Median Property Price: $290,000

- Price to Rent Ratio: 16

- Traditional Rental Income: $1,483

- Traditional Cash on Cash Return: 2.8%

Find a profitable multi family home for sale in the Atlanta real estate market now.

Want to conduct your own neighborhood analysis of the Atlanta real estate market? Check out Mashvisor’s real estate heatmap. Read this guide to learn more: Heatmap Analysis: The Secret to Successful Real Estate Investing.

You Know Where to Invest in Atlanta. Now What?

Now that you have a neighborhood in mind to begin Atlanta real estate investing, you may be looking at around a dozen or more investment properties for sale. Just as in the initial stages of your investment property search, you cannot select one of these listings at random and make an offer. Rather, your Atlanta property search should continue onto the final stage- the investment property analysis.

Let’s demonstrate the best way to do this using Mashvisor’s real estate investment software. Wherever you decide to invest in Atlanta real estate, you can enter the name of the neighborhood in Mashvisor’s real estate search engine. From there, you’ll be taken to a map that displays all the available properties for sale.

Can’t find any rental properties for sale at the moment in your neighborhood of choice? That’s why it’s important to have access to the tools that will help you perform your own neighborhood analysis like Mashvisor’s real estate heatmap.

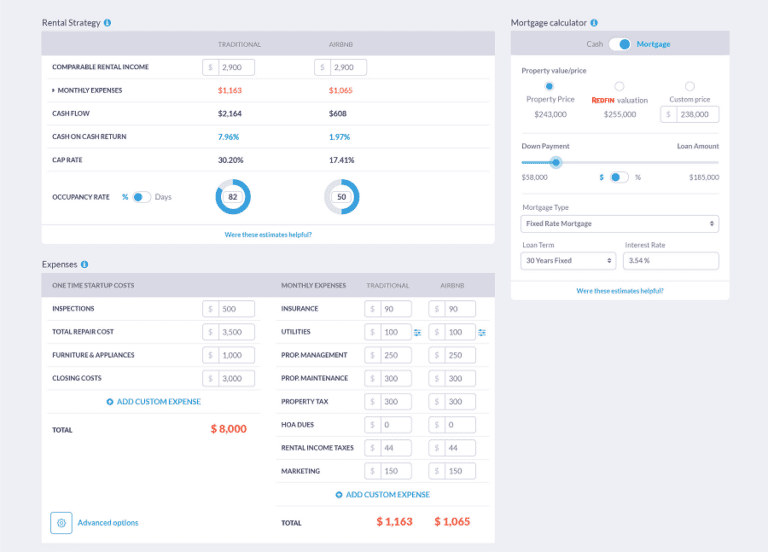

You can click on one of the listings and you’ll be taken to the property analysis page. Here, you’ll get access to our investment property calculator. This powerful data-driven tool will conduct an instant investment property analysis for you on any listing (MLS or even off market properties) in the Atlanta real estate market. From rental income to cash flow to cap rate and cash on cash return, this calculator provides it all:

And it will show you how each rental property will perform as either a traditional or Airbnb investment property. These traditional and Airbnb analytics will help you make up your mind on whether investing in Airbnb Atlanta properties is the right choice for you. Try it out for yourself and quickly find profitable cash flow properties in Atlanta.

Find Top-Performing Atlanta Income Properties Today

Ready to find and analyze the best Atlanta investment property? You can get started today with a 7-day free trial. This will give you access to Mashvisor’s real estate heatmap and investment property calculator along with our valuable Atlanta real estate market and property data.