In 2021, the California real estate market surpassed all previous records. It was a trending seller’s market in real estate.

Because of the high demand in all of California’s subsectors, limited inventory and flash market conditions aren’t going away anytime soon. Simply put, there aren’t enough properties for sale to meet buyer demand.

In this article, we will focus on what 2021 brought to the California housing market. We’ll break down each important factor and see what we can expect in 2022. Let’s start.

California Real Estate Market: Overall Statistics

In the January 2022 California Association of Realtors (C.A.R.) report, the average price in all of California’s main areas increased yearly, with all of them climbing by double numbers. The median price in 45 California counties has also been increased each year. Thirty-three of them increased drastically in two continuous years. In addition, California investment property prices have continued to rise due to the supply-demand imbalances and low borrowing costs.

- The San Francisco Bay Area experienced a 14.3% year-over-year price increase, with the median price standing at $1,200,000.

- Southern California experienced a 13.8% year-over-year price increase, with a median price of $740,000.

- The Far North experienced a 13.4% year-over-year increase, with a median price of $380,000.

- The Central Valley experienced the most considerable year-over-year price increase of 17.5%, with a median price of $455,000.

- The median price on the Central Coast increased by 10.9% year over year to $920,400.

- The Los Angeles Metro Area experienced an 11.1% year-over-year price increase, with a median price of $700,000.

- Inland Empire increased by 17.9% year over year, with a median price of $539,000.

Due to a lack of supply, the real estate market California remains a seller’s market, with property prices reaching all-time highs across the state. As purchasers battled for a limited supply of properties for sale, housing prices in every central region continued to rise from the previous year. Demand is increasing, resulting in bidding wars and greater selling prices.

Related: Buyers Market vs Sellers Market in Real Estate—Everything That You Need to Know

California Housing Market: Going up or Down in 2022?

C.A.R. polls 1,000 California customers every month about their attitudes on various areas of the housing marketplace or the economy that directly affect housing to generate the California Housing Sentiment Index. The total housing sentiment index hit 70 in September last year (-2 from the previous month). With the high price for houses and a dynamic, slowly improving economy continuing to lure more sellers back into the market, the California real estate market shows indications of normalcy.

Moreover, according to C.A.R., interest rates were good last week, and new listings maintained their rising trend. Despite increased mortgage applications and house sales having yet to happen, California customers have become somewhat more hopeful about purchasing within the last month. The rest of the year will likely continue at around the 400,000 unit level through December.

Reassuringly, the number of new listings uploaded to the MLS every day has now begun to outnumber closed sales, and C.A.R. continues to expect at least a 10% increase in house sales this year. If the economy gets better, rates may gradually rise, although many economists believe borrowing costs will stay low by historical standards.

Forecasts for the California Real Estate Market in 2022

Let’s take a peek at Zillow’s price patterns over the last few years. California investment property values have increased by approximately 146.7% since 2012, according to the Zillow Home Value Index. ZHVI is generated by taking the median of all expected home values for a specific region and month then adding extra changes to compensate for seasonality or inaccuracies in individual home estimations.

It is representative of the entire housing supply, not simply the residences that list or sell in a particular month. According to this estimate, California’s current average home value is $745,200. It means that half of the housing stock in the region is worth more than $745,200, while the other half is valued below this amount. This is further verified by Mashvisor’s February data, which shows that the median property price in the state is $1,089,649.

In January 2021, the average house value in California real estate market was roughly $618,000. Over the last year, property values have increased by 20.5%. It is possible to say that California is now a seller’s market, which implies that demand outnumbers supply, providing sellers an edge over buyers in price discussions. There are fewer available properties than there are interested buyers in the market. Purchaser demand remains strong, driving up property prices at a double-digit rate of increase.

California Market Competitiveness

Here’s a breakdown of California real estate market competition as of February 16, 2022, according to Mashvisor.

- Number of Listings for Sale: 19,421

- Median Property Price: $1,089,649

- Average Price per Square Foot: $954

- Number of Traditional Listings: 70,018

- Monthly Traditional Rental Income: $3,366

- Traditional Cash on Cash Return: 1.93%

- Price-to-Rent Ratio: 27

- Number of Airbnb Listings: 62,482

- Monthly Airbnb Rental Income: $5,129

- Airbnb Cash on Cash Return: 3.26%

- Airbnb Daily Rate: $270

- Airbnb Occupancy Rate: 65%

- Days on Market: 67

- Walk Score: 50

According to C.A.R.’s Traditional Home Affordability Index, California housing affordability increased in the fourth quarter of 2021.

What About Southern California Real Estate Market?

Although Southern California is a wonderful area to live in, the epidemic and an expensive Southern California real market have forced many residents to relocate—all the way to Mexico.

Year-over-year house prices in the Los Angeles metro area increased 15.2% in 2021, whereas prices in Southern California increased 15.4%. According to a Zillow report published in February, nearly half of America’s “million-dollar towns,” where the average house price is at least $1 million, are in California. The Los Angeles metropolitan region has 57 million-dollar cities, and the California real estate market has 44% of all million-dollar towns.

Affordable housing is becoming increasingly available for residents of these areas (Tijuana) south of the border. The newcomers are mainly Americans with American wages, and Kim King observes that their interest in Mexico’s housing market has driven up prices for everybody.

Ex-Californians disturbing housing pricing and markets in Mexico are also doing so in minor U.S. communities, as residents quit the Golden State in droves in search of more affordable places, frequently in states with more forgiving tax regimes.

In Mexico and places such as Nashville, Atlanta, and Miami, wealthier newcomers are driving up rates to the level that most locals can no longer compete and have decided to rent permanently.

Will California Rebound Lead the Nation in 2022?

The Delta Covid Variant, which took shape last year, has eased in the state. New problems about the Omicron variation are troubling. Still, scientists feel that current immunizations should protect, and one vaccine manufacturer claims that it could develop an Omicron-protective vaccine within three months.

Rent increase in the United States is substantial, ranging from 11% to 13%, but it lags significantly in California. On the other hand, rent increase in the California real estate market is still substantial in Anaheim, Bakersfield, Fresno, Los Angeles, Orange County, and San Diego. Considering the price, rental property investors face a challenging market.

As the healing from the pandemic accelerates, supply is becoming a concern. The neglect and excessive regulation of the California housing market might stymie economic expansion by driving away workers who can’t find a place to stay and driving up inflation, making life in California’s big cities tough.

Increased Interest in Small Cities

With more people attempting work-from-home solutions, we may see more employees able to relocate away from high-rent districts and possibly even out of California. Employers are becoming more accommodating of the need to work from home. The CEO of a prominent real estate firm indicated that interest in smaller areas is stronger than in major ones.

Regarding California real estate market, the anticipated high increase in interest in properties for sale in San Diego, Oakland, San Francisco, and Los Angeles has been a bit unsteady, but the trend is visible.

Top 5 Cities for Traditional Rental

Now that we have covered everything about the trending California real estate market let’s focus on the top five cities for traditional rental.

When deciding on an area to invest in, you must first study the data, particularly the occupancy rate and cap rate, to guarantee that you are making a successful investment. According to Mashvisor data, as of February 2022, the following California cities have been performing the best.

1. Lake Los Angeles

- Median Property Price: $364,111

- Average Price per Square Foot: $251

- Price-to-Rent Ratio: 12

- Monthly Traditional Rental Income: $2,488

- Traditional Cash on Cash Return: 5.30%

2. Red Bluff

- Median Property Price: $497,436

- Average Price per Square Foot: $260

- Price-to-Rent Ratio: 17

- Monthly Traditional Rental Income: $2,400

- Traditional Cash on Cash Return: 4.80%

3. Oro Grande

- Median Property Price: $242,600

- Average Price per Square Foot: $193

- Price-to-Rent Ratio: 14

- Monthly Traditional Rental Income: $1,396

- Traditional Cash on Cash Return: 4.45%

4. Blythe

- Median Property Price: $478,753

- Average Price per Square Foot: $308

- Price-to-Rent Ratio: 27

- Monthly Traditional Rental Income: $1,505

- Traditional Cash on Cash Return: 4.30%

5. Palm Desert

- Median Property Price: $710,632

- Average Price per Square Foot: $356

- Price-to-Rent Ratio: 16

- Monthly Traditional Rental Income: $3,602

- Traditional Cash on Cash Return: 4.01%

Top 5 Cities for Airbnb Rental

Based on Mashvisor data, the following are the top five cities in California housing market to consider for real estate vacation rental.

1. Bonita

- Median Property Price: $1,167,980

- Average Price per Square Foot: $532

- Monthly Airbnb Rental Income: $11,359

- Airbnb Cash on Cash Return: 6.61%

- Airbnb Daily Rate: $238

- Airbnb Occupancy Rate: 74%

2. Bloomington

- Median Property Price: $647,770

- Average Price per Square Foot: $442

- Monthly Airbnb Rental Income: $5,698

- Airbnb Cash on Cash Return: 6.39%

- Airbnb Daily Rate: $282

- Airbnb Occupancy Rate: 69%

3. Atascadero

- Median Property Price: $791,737

- Average Price per Square Foot: $473

- Monthly Airbnb Rental Income: $7,019

- Airbnb Cash on Cash Return: 6.55%

- Airbnb Daily Rate: $293

- Airbnb Occupancy Rate: 65%

4. Cherry Valley

- Median Property Price: $765,113

- Average Price per Square Foot: $542

- Monthly Airbnb Rental Income: $5,208

- Airbnb Cash on Cash Return: 5.90%

- Airbnb Daily Rate: $155

- Airbnb Occupancy Rate: 68%

5. Clearlake

- Median Property Price: $439,700

- Average Price per Square Foot: $358

- Monthly Airbnb Rental Income: $4,897

- Airbnb Cash on Cash Return: 6.85%

- Airbnb Daily Rate: $222

- Airbnb Occupancy Rate: 58%

Related: How to Find the Best Area for Airbnb Investment

How Can Mashvisor Help?

If you were looking for an investment property in any of these California cities and wondered how to invest in real estate, Mashvisor is the solution for you. Our platform is equipped with various tools that can assist you in locating investment property in the California housing market or anyplace else in the United States.

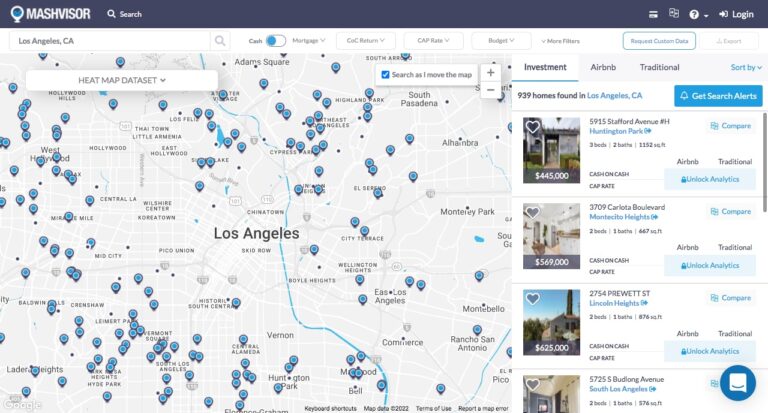

We created an Investment Property Search that allows you to browse through the various markets using a map interface to see where all of the properties for sale are situated, how they performed, and how they are predicted to perform in the future.

Related: The Ultimate Investment Property Search Tool

In contrast, the Property Marketplace feature allows you to browse around a virtual store where you can view properties for sale on and off the market and information about their prices, rental rates, and more. Using various criteria, you may narrow down your search results depending on the cost of the property, the return on investment, the percentage of time the property is occupied, or the rental strategy you want to employ.

Furthermore, once you’ve discovered one or more properties you’re interested in, you can use the rental property calculator tool to analyze each property for its investment potential. Each of these tools and more are available with our membership plans with almost no restrictions—all to assist you in making the transition from a newbie real estate investor to a skilled and accomplished investor.

Mashvisor’s Investment Property Search tool gives you a quick overview of the concentration of available listings for sale in a city.

Conclusion

Although it is far from perfect, the overall picture for the California real estate market in 2022 is optimistic. If you can afford it, purchasing a California investment property could result in real estate growth and cash flow the following year.

Make the most of your real estate venture. To book a free demo with Mashvisor or begin a free trial, click here.