Conducting a thorough rental property analysis before making a purchase is key to achieving a profitable investment. One of the most significant metrics that investors use to determine the profitability of an income property is the capitalization rate (cap rate). While the metric is most commonly used when comparing different investment properties, not many know how to calculate it effectively. To properly calculate the capitalization rate, a cap rate calculator would be beneficial.

You really don’t need to be a mathematical genius to calculate cap rate effectively. You just need to use the right tool. A real estate analysis spreadsheet used to do the job until technological advancement led to the emergence of a much better alternative – the real estate cap rate calculator. It is not only quicker and more accurate in calculating cap rate but also calculates other important real estate metrics.

Below, we’ll show you why Mashvisor’s cap rate calculator is one of the indispensable real estate investment tools for every real estate investor who wants to make a wise investment decision. But before we get into that, it’s important that you understand what cap rate really means and why it’s important.

What Is Cap Rate?

Capitalization rate refers to the ratio of an income property’s net operating income (NOI) to its current market value or purchase price.

Cap Rate = Net Operating Income / Current Market Price × 100

The cap rate is used to estimate the profitability of a rental property when paid for in cash. Consequently, it is the most popular metric for comparing multiple rental properties for sale without taking into account the method of financing.

Apart from measuring ROI, the real estate cap rate also measures the level of risk involved in buying a rental property. It means that rental properties with very high cap rates could be high-risk investments (in theory).

A good cap rate for rental properties will typically range from 8% to 12%. Nevertheless, it will vary depending on a number of factors, including location, property type, and investment strategy. A cap rate formula calculator will surely help determine the ideal figure for your investing strategy.

Related: What Is a Good Cap Rate for Rental Property in 2020?

Why Do You Need a Cap Rate Calculator?

As you can see, the cap rate formula is quite simple. Almost everyone can calculate the cap rate of a single investment property with ease. The problem comes when you want to compare cap rates for multiple rental properties to determine the best one. With hundreds of thousands of residential real estate listings in the US housing market, calculating cap rates can seem a daunting task.

While you can still use an investment analysis spreadsheet to calculate the cap rate for rental properties, it can be a tiresome and time-consuming process. Spreadsheets are also prone to error. Mashvisor’s rental cap rate calculator is the tool that makes your rental property analysis easy and more efficient regardless of your real estate experience. In just a matter of minutes, you can calculate cap rate and much more. To make informed decisions quickly and stay competitive, you should consider using the rental property cap rate calculator.

What Is a Cap Rate Calculator for Rental Property?

Time is very important in real estate investing. The task of finding the right property to invest in can be daunting, particularly for new investors, given the growing number of rental properties being listed every day in the US housing market.

As a real estate investor, you need to calculate the cap rate accurately and quickly in order to gain an advantage, especially in highly competitive rental markets. To do so, a cap rate calculator for rental property becomes very useful.

A cap rate rental property calculator helps in analyzing several rental properties for sale. The tool allows real estate investors to calculate the relevant metric and decide which rental property is suitable for their investment portfolio.

The Pros and Cons of Using a Real Estate Cap Rate Calculator

A real estate cap rate calculator helps real estate investors to calculate the important metrics when analyzing investment properties. But it also comes with its fair share of drawbacks. Here, we will look at the advantages and disadvantages of using a real estate cap rate calculator.

Advantages

- It makes property searches and analyses of different real estate metrics easier and faster, helping investors make informed decisions within a short period of time.

- It is useful when investing in both commercial and residential properties, particularly in tracking the performance of the real estate investment property at specific time intervals.

- Though the method of financing is not included in calculating the cap rate, it gives the investment property buyer the opportunity to adjust their financing method and the type and length of mortgage.

Disadvantages

- Calculating the capitalization rate does not consider the financing method (whether the property was bought in cash or through a mortgage).

- Cap rate does not include monthly mortgage payments when calculating the net operating income.

What Can You Calculate Using Mashvisor’s Cap Rate Calculator?

Successful investors know that there’s more to making a smart investment decision than just cap rate. What makes Mashvisor’s investment property cap rate calculator even more important for investors is that it provides more numbers and property data than just cap rate.

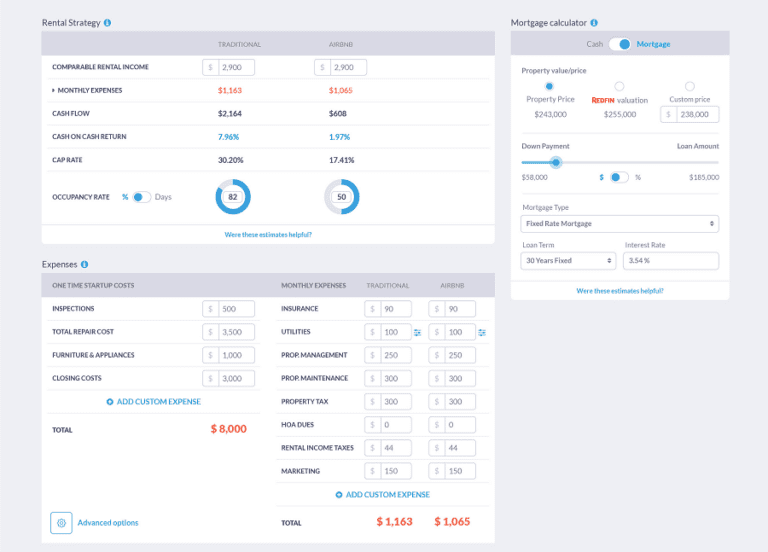

Here’s a glimpse of Mashvisor’s cap rate calculator. As you can see, you get so much more than cap rates!

Mashvisor’s cap rate calculator allows investors to analyze residential real estate listed on the platform. If your target property is not on the platform, you can add it by entering the address to proceed with your investment property analysis. After entering some basic details about the property, the calculator will provide you with a variety of metrics and data to help you determine its profitability. They include:

1. Cap Rate

As the name suggests, the cap rate calculator is used to calculate cap rate. The tool can quickly and accurately provide you with cap rate estimates for an unlimited number of properties. It will help you identify high cap rate properties for sale in your target real estate market.

2. Cash on Cash Return

The calculator will also provide you with accurate estimates of cash on cash return, another return on investment metric. It is the ratio of an income property’s annual pre-tax cash flow to the total cash invested. The metric is typically used to estimate the profitability of investment properties for sale that will be financed with mortgage loans.

The cap rate calculator can be used as a mortgage calculator to estimate how loan terms will affect the property’s return on investment. You simply add your property price and the mortgage details (mortgage type, down payment, loan amount, and loan term).

3. Rental Property Expenses

With the calculator, you can get estimates of the rental property expenses right away. This includes both one-time start-up costs and recurring monthly expenses relating to the rental property. These estimates are based on the location of the rental property and rental comps.

Cost estimates will help you determine if an investment property for sale is within your budget. However, the calculator also allows you to adjust the cost estimates given and to add your own.

Related: A Comprehensive List of Rental Property Expenses for Investors

4. Rental Income

With the help of the cap rate calculator, you can also get accurate estimates of expected monthly rental income for residential real estate in any US market. The data is based on rental comps (comparable properties in the area).

5. Cash Flow

When buying a rental property, cash flow is an important metric to consider. Cash flow is the difference between the rental income and rental expenses for each month. The cap rate calculator helps investors easily identify the best cash flow properties by providing cash flow estimates.

6. Airbnb Occupancy Rate

Airbnb occupancy rate shows the amount of time a rental property is occupied relative to the time it is available for booking. This is a key metric to consider when buying an Airbnb investment property since it will influence your return on investment.

7. Real Estate Comps

Your rental property analysis won’t be complete if you don’t determine the fair market value of your investment property. It will help you decide what price to offer and avoid overpaying. To value investment property, you should check how much similar properties in the area sold for recently. While on Mashvisor’s cap rate rental property calculator, you can get real estate comps for investment properties for sale with the click of a button.

8. Optimal Rental Strategy

One special feature of the cap rate calculator is that, for each metric, it provides values for both rental strategies (traditional and Airbnb). This allows you to easily compare traditional vs Airbnb investments and determine the optimal strategy.

9. Investment Payback Balance

If you are planning to implement a buy and hold real estate strategy, calculating the investment payback balance is important. It is the time it will take for an investment property to generate enough money to cover its investment costs. While on the cap rate calculator, you’ll see it in the Payback Balance section.

10. Tax History

Property taxes play a big role in the profitability of an investment property. Lower property taxes could mean more cash flow for you. With Mashvisor’s calculator, you can easily access a rental property’s tax history data (pulled directly from Zillow) and observe the trend.

Related: Invest in Real Estate in These States with No Property Tax

The Bottom Line

While cap rate is an important metric when assessing whether a rental property is worth buying, your decision shouldn’t be based on cap rate only. That’s why every investor should use Mashvisor’s cap rate calculator. With its real estate investment software tool, Mashvisor allows you to calculate all the key information you need to make a wise investment decision. You will be able to conduct your rental property analysis in a matter of minutes.

Sign up for Mashvisor today to access various tools and get all of the data you need to succeed in the US housing market.