2023 promises to be a good—yet competitive—year for real estate investing. To run a profit, you need the #1 investment property calculator.

Table of Contents

- 3 Challenges of Investing in Real Estate in 2023

- What Is a Real Estate Investment Calculator?

- Why Is Mashvisor’s Investment Property Calculator #1 for 2023?

After the turmoil of 2020-2022, US housing market predictions for 2023 point to some return to stability and normality. In general, next year is expected to be a great one for property investors.

Having just read that, are you looking to invest in real estate in 2023? Buying a rental property comes with a lot of benefits, such as ongoing passive income, long term appreciation, tax benefits, and equity.

However, many beginner investors end up losing money because of wrong investment decisions. While turning a negative cash flow income property into a positive one is possible, it is really challenging, especially for newbies. Investing in a profitable rental from the get-go is a much better approach.

So, how do you ensure that you purchase a profitable investment property?

The answer is: By conducting a thorough real estate market and property analysis using a reliable investment property calculator.

While there are numerous real estate investment calculators out there, the best rental property calculator that’s currently on the market is Mashvisor. It provides many benefits that other tools simply don’t have. Most importantly, you can use the Mashvisor real estate investing app to evaluate both long term and short term rental properties for sale.

Read on to learn why you need to use this real estate return on investment calculator before buying an investment property in the US real estate market in 2023.

3 Challenges of Investing in Real Estate in 2023

Investors and other professionals involved in the real estate market in recent years are used to facing—and overcoming—obstacles. Soon after recovering from the Great Recession, the US housing market was hit by the COVID-19 pandemic, the war in Ukraine, and the consequent inflation.

Generally speaking, experts expect 2023 to bring relative calm to the real estate industry, but that’s not to say that next year will not bring its own unique set of challenges to investors.

Here are the three major hurdles that rental property investors can expect in the coming year:

1. Skyrocketing Property Prices

According to Zillow, since the beginning of 2020, the price of the typical US home has gone up by 43%, significantly exceeding the average real estate appreciation rate. The reason for the steep increase had been the pandemic, which has led to a lack of listings and low inventory. We saw the toughest seller’s market we’ve experienced in decades.

Related: Will the 2023 US Housing Market Be a Buyer’s or Seller’s Market?

A panel of 19 real estate experts that Mashvisor has recently interviewed agree that the insane increase in residential property prices is over. However, it doesn’t mean that home values will start dropping. On the contrary, real estate professionals predict that appreciation will be around 2%-3% in 2023.

While the above figure is much less than the growth we saw in the past two years, affordability will remain a major constraint in the coming years. Rental property prices will remain high, especially in major cities like New York, San Francisco, Los Angeles, Miami, Seattle, and Dallas. In the said markets, median property prices are close to or over the $1-million mark.

The extremely high property values will pose a major challenge, especially to first-time real estate investors with limited capital, equity, and borrowing options. However, there are ways to overcome this difficulty and still buy a money-making investment property in 2023.

One strategy is to go for one of the most affordable housing markets. Indeed, less expensive locations and listings tend to provide a better return on investment than their more expensive counterparts. After all, the property price affects all ROI metrics (cap rate, cash on cash return, etc.) in real estate in a negative way.

Shortly, we’ll discuss how to find affordable locations for investing in traditional and Airbnb rental properties.

2. Unaffordable Mortgage Rates

Another factor predisposing the 2023 real estate market to develop a perfect storm is the skyrocketing mortgage interest rates. Mortgage rates were not as quick as property prices to react to the pandemic. Actually, last year, they hit historic lows before taking on a steep upward trend this year.

Currently, the 30-year fixed-rate mortgage interest rate stands at 6.92%, the highest level since April 2002. In August, Fannie Mae published a forecast, according to which mortgage rates would average 4.5% in 2023. However, the prediction was made when rates were still hovering around the 5% benchmark.

Related: October 2022 Opens With Mortgage Rates Going Up

Since August, mortgages have become increasingly expensive. So, it’s safe to assume that 2023 will witness relatively higher mortgage interest rates, at least in the first few months. As a result, unaffordable conventional mortgage loans will be another challenge that investors will need to overcome next year.

One way to go around the issue is to search for alternative financing options like FHA loans, hard money loans, private money lenders, syndication, crowdfunding, or partnerships. Access to the said borrowing opportunities gives rental property investors an advantage over homebuyers who generally need to rely on a mortgage loan.

Another solution is to look for housing markets with lower home values, as discussed above. Both the down payment and the monthly mortgage payments are lower if your investment property costs less.

3. Increased Competition From Homebuyers

The lack of MLS listings for sale and the crazy home price increases drove the majority of first-time homebuyers out of the market between 2020 and 2022. Such trends added to the other uncertainties of the pandemic to prevent many millennials and others from owning a home.

As some of the real estate trends are expected to reverse in 2023, the forecast is that homeowners will start returning to the market. Their presence will increase the competition that investors face and add a further obstacle, particularly for newbies.

Once again, there are real estate investment strategies for beginners that can help them locate profitable opportunities in the US housing market 2023.

One thing that investors can do is look for off market properties like foreclosures, REOs, and bank-owned homes. Usually, homebuyers and even most property investors don’t have access to such deals so the competition will be less. Furthermore, these investment properties are generally available at discounted rates, especially if they are distressed and need some repairs.

Another step rental property investors can take is to focus on markets with a high price to rent ratio. It’s true that such markets might offer slightly lower ROI, but they guarantee less competition from homebuyers and strong rental demand due to high property prices.

Related: 20 Best Markets for Real Estate Investing in 2023

While 2023 poses some unique challenges to investors, making good real estate investments is absolutely feasible.

How?

With the help of the #1 investment property calculator!

Relying on manual calculations in an Excel spreadsheet will not do the trick in 2023.

What Is a Real Estate Investment Calculator?

Before figuring out the best calculator for real estate investors in 2023, we need to define what an investment property calculator is.

An investment property calculator is an online tool or platform that helps investors find and analyze the potential of markets and properties before buying them. It’s also referred to as a rental property calculator and real estate investment ROI calculator, as well as a cash flow calculator, cap rate calculator, and cash on cash return calculator.

The #1 calculator for investment properties must rely on access to nationwide real estate and rental big data in addition to AI and machine learning algorithms. In a market driven by technological advancements and competition, savvy investors should use the power of real estate tech in order to land profitable deals.

Related: Mashvisor’s Real Estate Data and Analytics: Must-Have for Investors

In 2023, gathering data manually, entering it into Excel spreadsheets, and making their own calculations there will not allow investors to run a profit. Other investors are already using real estate software tools.

Why Is Mashvisor’s Investment Property Calculator #1 for 2023?

The Mashvisor investment property calculator is a digital tool that can help you find lucrative investment properties for sale in the US residential market. To attain a profitable real estate investment, you need to choose the right location, buy the best investment property, and select the optimal rental strategy.

Mashvisor’s real estate investment calculator helps you achieve your goals. It enables you to find and analyze both neighborhoods and rental properties for sale. Just enter some basic information reflecting your investment criteria, and the investment calculator real estate tool will do all the work.

The tool is quick and accurate as it uses reliable traditional and predictive analytics based on the performance of long term and short term rental comps in the area. One of the best features of the Mashvisor real estate calculator is that you can analyze both traditional rentals and vacation rentals.

It is something that no other online platform offers. For example, AirDNA helps investigate Airbnb rentals, while Rentometer assists in optimizing the performance of long term rentals. Mashvisor combines both functionalities, which is why it’s the #1 investment property calculator for 2023.

Related: AirDNA vs Mashvisor: Which One Is the Better Source of Airbnb Data?

Overall, Mashvisor will save you a lot of time and effort in analyzing potential real estate deals, regardless of your rental strategy. Meanwhile, your investments are guaranteed to be the best across the US market.

Sign up for Mashvisor now and get 15% off.

Let’s take an in-depth look at how Mashvisor’s investment property calculator can help you with two of the key steps in buying positive cash flow properties with a good cap rate in 2023. Specifically, we’re referring to rental market analysis and investment property analysis.

1. Neighborhood Analysis

Location is the most important factor in real estate investing as it is the largest determinant of your return on investment. Therefore, you need to conduct a thorough real estate market analysis to locate the best-performing markets.

Choosing the city to invest in is quite easy as you can find city data online, such as on Mashvisor’s real estate blog. However, it is only half of your market research. You must narrow down your property search to a particular neighborhood in your city of choice.

Similar income properties in different areas within the same city can command very different prices and generate significantly different returns. Contrary to popular belief, real estate markets are highly local.

Mashvisor’s investment property calculator helps you find the best neighborhood for your budget and investment strategy easily and quickly. With just a few clicks of the mouse, you can conduct a comprehensive neighborhood analysis.

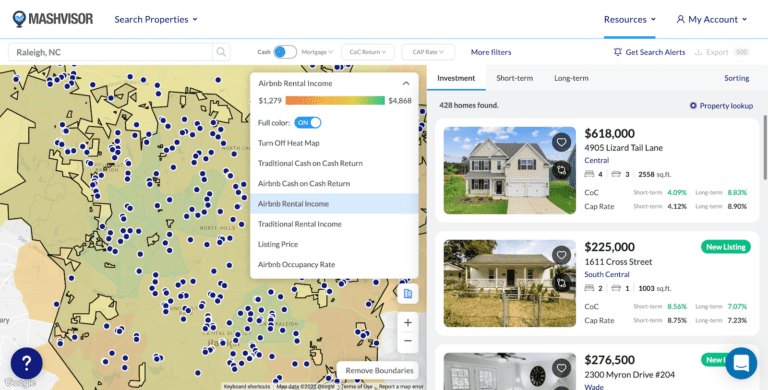

Mashvisor’s Real Estate Heatmap

One easy and efficient way to begin your neighborhood analysis is to use Mashvisor’s real estate heatmap. The heatmap tool uses different color codes to show the performance of neighborhoods in your market of choice based on several metrics, including:

- Listing price

- Rental income (Airbnb and traditional)

- Cash on cash return (Airbnb and traditional)

- Airbnb occupancy rate

Airbnb Rental Income in the Raleigh Real Estate Market

Just select one of the above filters, and the Mashvisor heatmap will point you to the direction of the areas that meet your expectations. You can easily find local markets with low property prices, high rental income, and above-average ROI.

Mashvisor’s Neighborhood Analysis Pages

After identifying what seem to be top-performing neighborhoods that fit your budget, you can do a more in-depth analysis of the neighborhoods using Mashvisor’s calculator.

The real estate investment calculator will provide the following neighborhood-level real estate data and analytics on the neighborhood analysis pages:

- Mashmeter score

- Median price

- Average price per square foot

- Average rental income

- Average cash on cash return (Airbnb and traditional)

- Average Airbnb occupancy rate

- Optimal rental strategy

- Optimal property type

- Number of listings for sale

- Number of rentals (Airbnb and traditional)

- Walk Score

- Transit Score

- Bike Score

- Real estate comps

Mashvisor also allows you to download a full report for the neighborhood you are analyzing. The report includes all the property listings in the area, as well as their stats in an Excel format to help you easily compare the investment potential of different areas.

The Excel sheet format supported by the Mashvisor real estate investment calculator is an excellent way to understand the projected value of investment properties. You can share the information with your agent or with your family when making your investment decisions.

Related: Neighborhood Analysis in Real Estate Investing

2. Investment Property Analysis

Once you’ve decided which neighborhood to invest in, the next step is to find the most profitable income property for sale you can buy. It will require that you analyze multiple property listings that fall within your budget and fit your investment goals. It will help determine the best one for your particular case.

Since you already have a good idea about the optimal property type and rental strategy from your neighborhood analysis, you need to focus your search on the said properties.

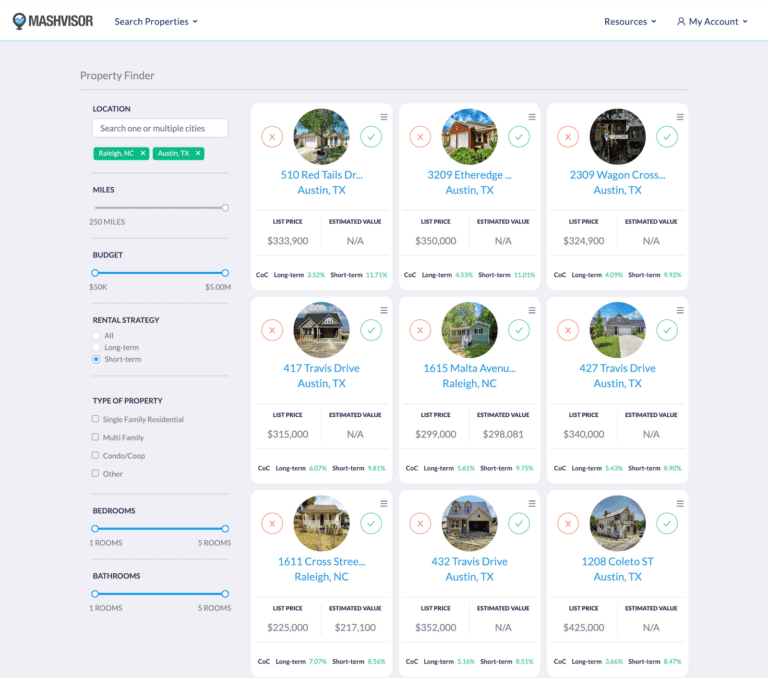

A quick and efficient way to do your investment property search in 2023 is to use Mashvisor’s Property Finder. The tool will scour your target market and provide you with a list of properties that match your exact search criteria and offer a high return on investment potential.

Mashvisor’s Property Finder: Top-performing investment properties for sale in two cities

You can also use the Mashvisor investment property search engine, which includes more filters to choose from. You can set your market, budget, financing method, expected rental income, ROI, and other requirements. The filters can be easily rearranged based on various factors.

Related: How to Get Access to the MLS Database Without a License

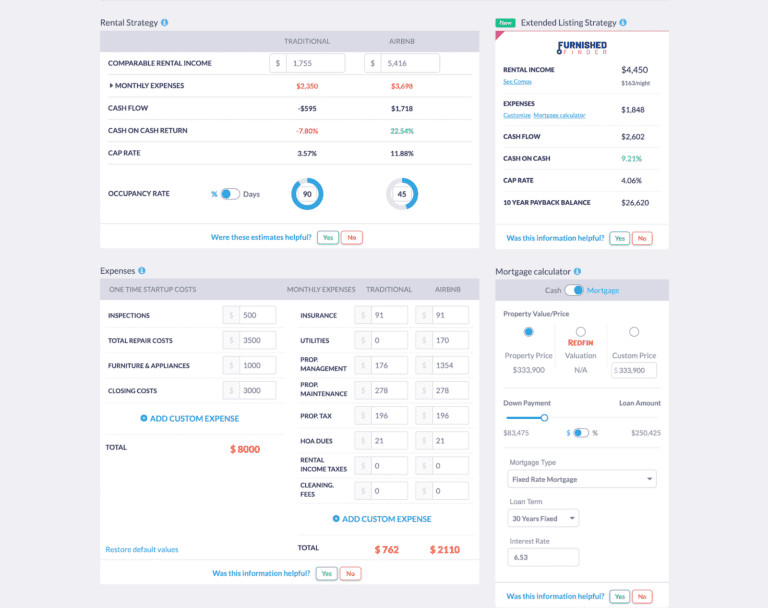

In addition, one of the best features that Mashvisor offers is the return on investment calculator real estate tool. It is an interactive real estate investment calculator that you can modify and customize in line with your needs and strategy.

Here is a list of the real estate and rental data and analytics that you will obtain on the Mashvisor real estate analysis platform:

Rental Expenses

Mashvisor’s investment property calculator provides investors with accurate estimates of one-time startup costs and recurring rental property expenses. Monthly expenditure estimates are useful in determining the potential cash flow. On the other hand, the startup cost estimates will help you know your upfront investment. Both factor in various real estate ROI measures.

The cost estimates provided by Mashvisor include:

One-Time Startup Costs

- Closing costs

- Home inspection

- Furniture and appliances

- Home repairs

Monthly Expenses

- Property insurance

- Maintenance

- Property tax

- Property management expenses

- HOA dues

- Marketing

- Rental income tax

- Utilities

Both startup and recurring expenses vary widely, depending on your market, property type and size, rental strategy, and selected rental property management method.

For example, furnishing a property in a large city costs significantly more than in a secondary or tertiary market. Similarly, covering utilities and restocking for a vacation rental adds up to much more than owning a long term rental.

Rental Income

The #1 investment property calculator for 2023 can also be used as a rental income calculator as it provides rental income estimates. To estimate rental income on your own, you’ll need to locate rental comps in the area, collect data on them, and enter it into an Excel spreadsheet. It is a process that is time-intensive and requires a lot of effort.

Related: Rental Comps: What Are They and Where Can I Find Them?

Mashvisor’s calculator saves you time and energy as it offers readily calculated estimates for Airbnb and traditional rental income. The estimates are based on the current and historical performance of long term and short term rental comps in the local market.

Cash Flow

With estimates for rental income and rental expenses, you can calculate the potential cash flow. As a beginner investor, you should always aim to buy positive cash flow income properties to achieve a real estate profit. Don’t purchase a negative cash flow property hoping to get better luck than local landlords or Airbnb hosts.

In 2023, you don’t need to calculate cash flow on your own, as Mashvisor’s rental property cash flow calculator will provide you with readily calculated data on this ROI metric. The calculation will be available whether you plan to rent out on a short term or long term basis.

Return on Investment

The main reason real estate investors conduct rental property analysis is to determine the profitability potential of the house they are considering buying. It is mainly indicated by return on investment. The two key ROI metrics in real estate are cap rate and cash on cash return.

The calculations can be very difficult to do manually, especially when analyzing multiple rental property investments. However, with Mashvisor’s cash on cash return calculator and cap rate calculator, in 2023, you can access readily available estimates for the said ROI numbers.

Mashvisor’s investment property calculator automatically estimates the ROI of a specific property for sale.

Our return on investment calculator also comes with an inbuilt investment property mortgage calculator. The tool’s interactive feature allows you to calculate your potential cash flow and cash on cash return based on the mortgage information you put in.

You can enter the following information to determine the property’s ROI:

- Property price

- Loan amount

- Mortgage type

- Loan term

- Down payment

- Interest rate

In addition to using the mortgage calculator, you can adjust and add startup and recurring expenses related to owning the property for a more comprehensive calculation. Mashvisor’s real estate return on investment calculator will automatically recalculate the expected cap rate and cash on cash return to reflect the new numbers.

It means that you won’t need to gather the data on your own for each property that you want to analyze. It significantly reduces the amount of time needed to analyze each property and makes it much easier for beginner investors to access traditional and Airbnb analytics.

Occupancy Rate

Occupancy rate is a measure of rental demand, which will exert a huge impact on your rental income and return on investment results. While the metric is important for long term rentals, it is absolutely crucial for vacation rental homes.

Nevertheless, estimating the expected occupancy rate of long term and short term rental rentals is very hard, as it depends on many factors. The different factors include the desirability of the location, the local economy and labor market, and tourist attractions. The current market conditions, type of property, and marketing skills also play a role.

In 2023, Mashvisor’s investment property calculator will provide accurate traditional and Airbnb occupancy rate estimates for you based on the performance of rental comps in the area.

Importantly, you can adjust the pre-set numbers in case you believe that you can outperform the local market because of superior amenities or special marketing skills. Any changes you make to occupancy estimates will be reflected in the calculations of the other metrics.

Optimal Rental Strategy

For each of the key metrics that the rental property investment calculator provides, you’ll get values for both Airbnb and traditional rental strategies. In most cases, measures will vary majorly depending on the rental strategy.

The availability of both sets of metrics will help you easily compare the rental strategies and decide on the best one for a particular property. Mashvisor is unique in that it provides data analysis for long term and short rental strategies, whereas most other tools focus on only one.

The feature is very helpful, given the ever-growing popularity of vacation rentals as a lucrative way to make a profit in the rental market. The data that Mashvisor provides for such types of rental properties can enable beginner investors to take advantage of the high profit potential.

Meanwhile, they will be able to mitigate many of the risks associated with investing in Airbnb for sale. In case the local short term rental regulations change, and Airbnb is no longer a feasible option, property owners will know the potential ROI if they flip to a traditional rental.

Real Estate Comps

Real estate investors need to examine recent sales of similar properties in the area, known as real estate comps, to determine if the purchase price is reasonable to avoid overpaying. When determining their rent estimate, investors also need to look at rates charged by comparable rental listings in the area.

Finding real estate comps and rental comps is made easier with Mashvisor’s investment property calculator. It will give you a list of comps and other relevant information to help you do your own comparative analysis. This way, you can easily boost your ROI by paying the right price and charging the right rental rate.

Related: The 6-Step Guide to Real Estate Competitive Market Analysis

Meeting the Challenges of 2023 With the Mashvisor Rental Property Calculator

Importantly, Mashvisor’s real estate investment platform helps you face and overcome all the obstacles that we can expect in the real estate market 2023:

- High property values: With Mashvisor, you can focus your investment property search on areas and listings with affordable prices. All you need to do is to set up the appropriate filters to see top-performing rental properties that will not break the bank.

- Extreme mortgage rates: The Mashvisor mortgage calculator allows you to figure out the best financing option for your particular situation. You can experiment with different down payment amounts, loan terms, and interest rates to see how they impact ROI.

- Competition from homeowners: You can choose long term and short term rentals for sale with high occupancy rates. The occupancy rate is an indicator of rental demand, and locations with strong demand typically feature high renters vs homeowners ratios. It means less competition from people looking to buy a home.

Getting Started With the Best Calculator for Investment Properties

To become successful in your real estate investment endeavor, you need to find the right property in the right location. It requires in-depth real estate market analysis and investment property analysis. Traditionally, the entire process takes weeks or even months, which is time that investors simply cannot spare in today’s competitive market.

With Mashvisor’s investment property calculator, you’ll be able to pinpoint the best neighborhoods and the best investment properties for sale in a matter of minutes. It can help you even if you’re a beginner investor with little money and no previous experience.

While real estate investment calculators are a relatively new addition to the real estate market, they’ve quickly become an indispensable part of the arsenal of successful property investors. They provide invaluable data and insights that enable just about anyone to make smart and profitable investments in rental properties.

So, if you’re still hesitant about buying a long term or short term rental property, Mashvisor’s tools can make your decision much easier and beneficial. That’s because our platform helps you overcome the challenges that prevent many others from investing in real estate properties.

To start looking for and analyzing the best investment properties in your city and neighborhood of choice, sign up for a 7-day free trial, followed by 15% off for life.