Due to the coronavirus pandemic, some real estate investors have been experiencing much higher vacancy rates than usual. While vacancies are inevitable, it’s imperative for every landlord to understand how to keep their vacancy rate as low as possible. A vacant rental property isn’t generating any income. And so you’ll be forced to cover any rental property costs from your own pocket or cash reserves. You’ll be dealing with a negative cash flow property. Therefore, a low vacancy rate is key to generating a good return on investment.

Related: 5 Risks That Come with a Rental Property and How to Mitigate Them

In this article, we’ll explore the meaning of this key metric and discuss how to keep it low so as to maximize your returns.

What Is Vacancy Rate?

Vacancy rate in real estate is a metric that measures the ratio of the amount of time that a rental property is unoccupied vs the amount of time it could be rented throughout a period of one year. For multifamily properties, it could mean the number of vacant units expressed as a percentage of the total number of units available for rent in a building at a particular time.

It’s essentially the opposite of occupancy rate. If the calculations are done properly, the sum of the vacancy rate and the occupancy rate should total 100%. When a rental property has a vacancy rate of 100%, it means that it doesn’t generate any revenue. A high vacancy rate is one of the main reasons many real estate investors struggle or fail in the business.

How to Calculate Vacancy Rate

As mentioned, the vacancy rate for multifamily properties is usually calculated by taking the number of vacant units, dividing it by the total number of available units, and multiplying the result by 100.

Here’s the basic vacancy rate formula:

Vacancy Rate= Number of Vacant Units / Total Number of Available Units × 100

Single-family homes and other rental properties with one unit typically use the following formula:

Vacancy Rate= Number of Days Unoccupied / Total Number of Days Available for Rent × 100

Why Is It Important to Understand Vacancy Rates?

Vacancy rates are crucial to real estate investors because they show how a rental property is performing relative to other properties in the area. They can be used as an analytic metric. However, for an effective comparison, the properties should be similar and located in the same neighborhood or housing market.

A high vacancy rate generally shows that a rental property is undesirable and is not renting well. On the other hand, a low vacancy rate can depict that the property is desirable and people want to live in it.

While vacancy rates are typically used to analyze an individual rental property’s performance, they are also economic indicators used to assess the overall strength of a housing market. Vacancy rates usually vary from market to market and sometimes from neighborhood to neighborhood. A high average vacancy rate is usually an indication that the area is unappealing to renters or has an oversupply of rental units. Conversely, if the area has a low average vacancy rate, there are likely many potential renters.

9 Ways to Keep Your Vacancy Rate Low

Rental vacancy rate has a direct effect on rental income, which in turn affects your cash flow and return on investment. With a high vacancy rate, you may be unable to make your monthly mortgage payments and risk falling into foreclosure. The cost of tenant turnover is also high and can kill profitability.

While high vacancy rates can be a result of many factors, there are some specific strategies that investors can implement to keep them low. This should be the priority of every landlord who wants to be successful.

Here are some of the key ways to keep the vacancy rate for rental property low:

1. Invest in desirable neighborhoods

One of the best ways to ensure you attract tenants (and keep them) is to buy investment properties that are located in nice neighborhoods with high job growth, good transportation, infrastructure, and essential amenities like schools, hospitals, restaurants, etc. Tenants are more comfortable living in such neighborhoods. A rental property located in an undesirable area will always be harder to rent.

Learn More: Neighborhood Analysis in Real Estate Investing

2. Analyze rental properties before making a purchase

Even after you identify a good rental market, you still want to look into the occupancy rates of the rental properties for sale. To ensure that you buy an investment property with a low vacancy rate, use Mashvisor for your vacancy rate analysis. Mashvisor allows you to quickly estimate vacancy rates by providing reliable occupancy rate data for real estate markets and investment properties in the US housing market. This is made possible with the help of Mashvisor’s vacancy rate calculator.

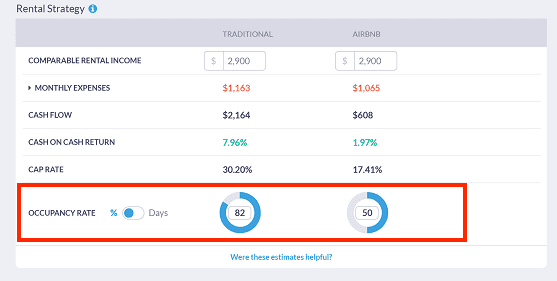

Mashvisor’s Investment Calculator provides occupancy rates for both traditional and Airbnb rental properties so you can figure out your potential vacancy rate.

3. Ensure your rental property is clean and in good condition

People want to live in premises that are clean and well-maintained. If your investment property is filthy and in need of many repairs, it will repel potential tenants.

To minimize vacancy, you always want to make a great first impression to potential tenants. Apart from ensuring that your property is operating in top condition, be sure to spruce up the exterior through landscaping, frequent repainting, trimming trees and shrubs, etc. This will help you attract and keep tenants.

4. Add some extra amenities and upgrades

Depending on what other similar rental properties in the area are offering, you can decide to stand out from the competition by offering a few unique amenities and making property upgrades. This may include a swimming pool, washing machine, gym, updated appliances, etc. Focus on amenities and improvements that won’t break the bank and are desirable to your target tenants.

5. Improve your marketing strategy

To effectively market vacant units, you should use multiple marketing strategies (online and offline) to boost your chances of getting a tenant quickly. Clearly show potential tenants why your rental property is the best in the housing market and why they should consider living there.

6. Screen tenants thoroughly

To keep turnover low, be stringent with tenant qualifications. Getting high-income, stable, reliable, and responsible tenants will make your life as a landlord easier and also keep your vacancy rate down.

7. Keep your rent in line with market rates

To stay competitive, you need to research the going rental rates for similar properties in your local market (rental comps). If you charge too much rent compared to what your competitors are charging, you are likely to be left with a vacant property. Look to offer your tenants a better deal than your competitors.

8. Prioritize customer service

One of the easiest ways to keep vacancy rate low is to keep your tenants happy by quickly responding to their maintenance requests and other issues. Whenever possible, act quickly to resolve any issues that may make your tenants uncomfortable or pose a safety or health risk.

If tenants are unable to reach you or have to wait for long for an action to be taken, they are likely to vacate. Ensure good communication with your tenants to gain their trust and confidence.

9. Offer incentives

One great way to keep rent-paying tenants is to offer them some sort of incentive to stay. For instance, you can offer a reduction in rent for one month if they sign another one-year lease. This will make them feel appreciated and they are likely to stay put.

The Bottom Line

There are a number of ways that landlords can lower their vacancy rates and this list is by no means exhaustive. We have just provided you with a few key strategies to get you started. Depending on your individual situation, you may need to employ other strategies.