With Dallas being one of the 10 best places to invest in real estate according to PwC, you must be wondering whether investing in Airbnb Dallas rentals is a good strategy. To prevent unnecessary suspense, we’ll tell you right away that it is. The rest of this article will show you why Dallas vacation rentals are one of the best ways to invest money as well as the top Dallas neighborhoods for this rental strategy.

How Will Dallas Airbnb Rentals Perform?

The most important factor in any real estate investing decision – from buying rental property to choosing the optimal rental strategy – should be the expected return on investment. Whether you focus on cap rate or cash on cash return, you should make sure that the forecast rate of return is good. So, let’s take a look at how the Dallas real estate market is looking in terms of Airbnb vacation rentals.

Expected Performance of the Dallas Housing Market

- Median Property Price: $411,900

- Price per Square Foot: $200

- Listings for Sale: 3,822

- Average Days on Market: 75

- Monthly Airbnb Rental Income: $2,980

- Average Airbnb Cap Rate: 2.0%

- Average Airbnb Occupancy Rate: 53.9%

The data above has been generated by Mashvisor’s Airbnb calculator, one of the must-have real estate investments tools. Our calculator uses big real estate data and predictive analytics to provide real estate market analysis as well as investment property analysis in a matter of minutes.

When looking at the Dallas real estate market analysis above, experienced property investors might be concerned about the average capitalization rate for Airbnb Dallas rentals. 2.0% does not seem like a lot when traditionally a good cap rate is placed in the range 8%-12%. However, what beginner real estate investors should take into consideration is that this is just a city-level average cap rate.

As we will see in a bit, the best neighborhoods in Dallas for investing in a vacation home offer a significantly higher return on investment. Moreover, according to Airbnb data from Mashvisor, other best places to invest in short term rentals generate even lower average cap rates at the city level.

Related: Airbnb Data: What Real Estate Investors Need and Where to Get It

The good cap rate provided by Dallas, Taxes vacation homes is the result of an above-average Airbnb occupancy rate and high nightly rates. This leads to high Airbnb rental income, placing Dallas among the best locations for investing in vacation home rentals.

Wondering what’s required for starting an Airbnb business? Read our comprehensive guide on how to become an Airbnb host.

Is Airbnb Dallas Legal?

Before we move any further in our discussion of the profitability of the short term rental strategy in the Dallas real estate market, we have to consider the Airbnb laws and regulations there. Many top locations for short term rentals have imposed restrictive and even prohibitive regulations in this regard, but fortunately for those considering buying an investment property in the Dallas housing market, this is not one of them.

Indeed, Airbnb Dallas remains one of the top choices for both local and out of state real estate investors interested in vacation rentals in specific. Why? Because the local authorities have not imposed any restrictions or negative regulations on short term rentals in Dallas whatsoever. While a 7% city hotel occupancy tax and a 6% state hotel occupancy tax have to be paid, the Airbnb income is high enough to generate good return on investment for vacation rentals Dallas, Texas.

So, if you are looking for one of the best places to become an Airbnb host in the US housing market, consider Dallas.

What’s Driving Dallas Short Term Rentals?

There are a number of factors which come together to make Airbnb Dallas one of the best real estate investment strategies. These include:

1. Tourism

Over 25 million visitors come to Dallas each and every year, pushing up the demand for Dallas short term rentals. This is a prerequisite for a high Airbnb occupancy rate, something which Dallas definitely has. Tourism is Dallas is driven by the numerous attractions.

2. Economy

In addition to leisure tourists, the Dallas real estate market also welcomes a significant number of business travelers. This is due to the strong economic performance and the position of Dallas as a major business and tech hub not only in Texas but also nationally. Of course, this is a positive factor for the Airbnb Dallas rental business.

3. Favorable Legal and Regulatory Environment

As mentioned above, Airbnb Dallas is one of the few major US cities which has not faced repressive regulations. Naturally, the lack of restrictions has turned into a catalyst for strong performance of Dallas vacation rentals.

4. Property Prices

Last but not least, we should not forget that the purchase price is just as important as the rental income for the positive cash flow and the return on investment which a rental property will provide – whether a traditional investment property or an Airbnb property. The listing prices of homes for sale in Dallas, TX remain much below the values in other top-performing markets, which allows for a high cap rate.

What Are the Best Dallas Neighborhoods for Vacation Rentals?

Knowing that Airbnb Dallas is a profitable investment opportunity is just a part of the story. Knowing where exactly to invest in a vacation home in the Dallas real estate market is just as important.

No worries, you don’t have to spend weeks and maybe even months researching different areas in Dallas and the performance of Airbnb rentals there to decide where to buy an Airbnb investment property. All you have to do is to look at the neighborhood analysis data provided by Mashvisor’s rental property calculator below. Following are the top Dallas neighborhoods for short term rental properties, based on Airbnb cap rate:

1. Near East

- Median Property Price: $331,300

- Price per Square Foot: $231

- Listings for Sale: 25

- Average Days on Market: NA

- Monthly Airbnb Rental Income: $2,390

- Average Airbnb Cap Rate: 6.5%

- Average Airbnb Occupancy Rate: 47.7%

2. Southeast Dallas

- Median Property Price: $181,400

- Price per Square Foot: $123

- Listings for Sale: 183

- Average Days on Market: 45

- Monthly Airbnb Rental Income: $2,370

- Average Airbnb Cap Rate: 5.9%

- Average Airbnb Occupancy Rate: 49.7%

3. Dells District

- Median Property Price: $260,700

- Price per Square Foot: $181

- Listings for Sale: 69

- Average Days on Market: 23

- Monthly Airbnb Rental Income: $2,400

- Average Airbnb Cap Rate: 3.7%

- Average Airbnb Occupancy Rate: 54.0%

4. Southwest Dallas

- Median Property Price: $252,400

- Price per Square Foot: $130

- Listings for Sale: 80

- Average Days on Market: 13

- Monthly Airbnb Rental Income: $2,280

- Average Airbnb Cap Rate: 3.5%

- Average Airbnb Occupancy Rate: 49.6%

How to Find the Best Airbnb Dallas Rental Properties?

The answer to this question is short and easy: By using the best real estate investment tools. Mashvisor’s Airbnb analytics platform has developed a number of software tools that help investors conduct neighborhood analysis and rental property analysis quickly and efficiently. All the Airbnb analytics are based on data on the actual performance of existing Airbnb Dallas rental properties.

Related: How to Conduct a Thorough Airbnb Investment Analysis

These tools include:

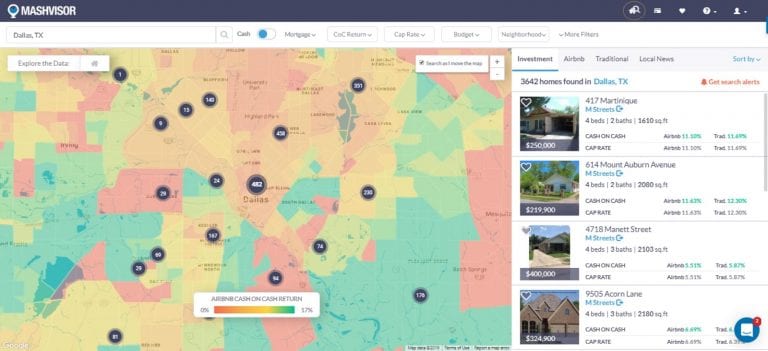

- Heatmap: The heatmap analysis tool provides investors with a Dallas neighborhoods map which highlights the most affordable locations for buying an investment property as well as the areas with the highest Airbnb rental income, Airbnb occupancy rate, and Airbnb cash on cash return.

Related: Airbnb Rentals: Finding Income Properties Using a Heatmap

Heatmap: Best Dallas Neighborhoods for Airbnb Cash on Cash Return

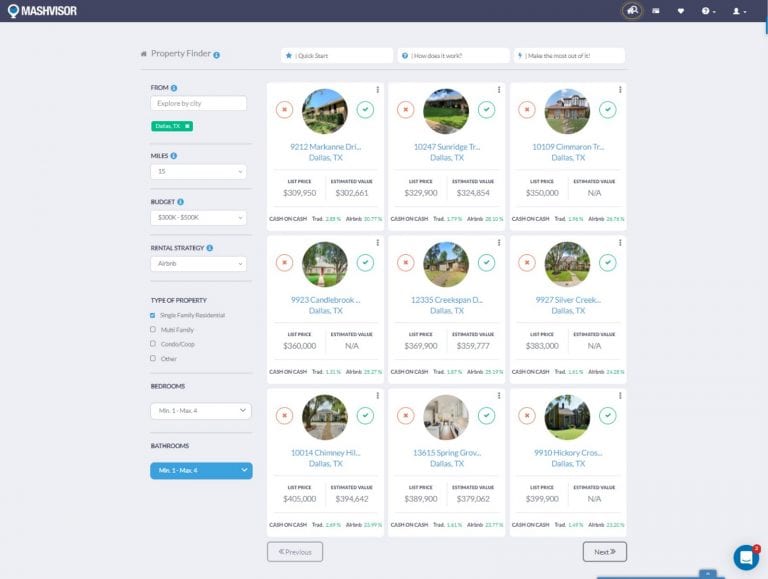

- Property Finder: The Property Finder tool allows real estate investors to search for top-performing Airbnb investment properties (as well as traditional rentals) in the Dallas housing market – or any other – by such criteria as their budget, preferred property type, and optimal number of bedrooms and bathrooms.

Property Finder: Top-Performing Airbnb Dallas Properties

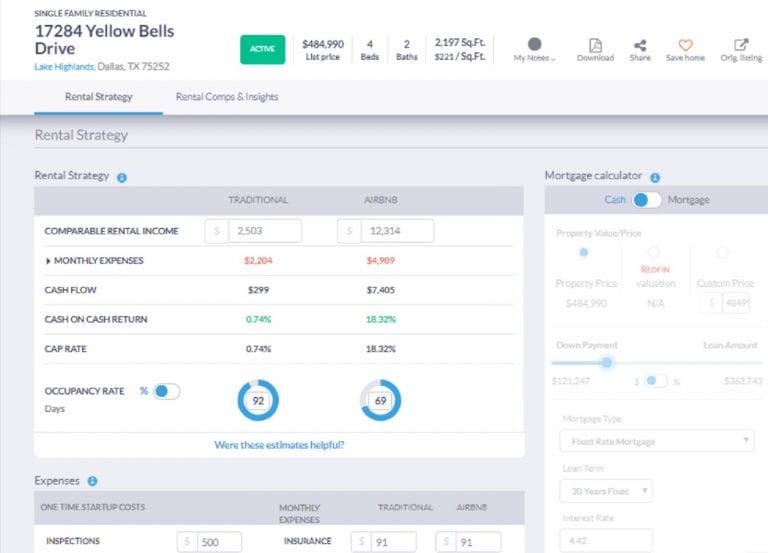

- Investment Property Calculator: Once investors have narrowed down their Airbnb Dallas property search to just a few homes for sale, they can have a look at the detailed investment property analysis of each of them to see the startup costs, recurring expenses, financing method, cash flow, Airbnb rental income, Airbnb cap rate, Airbnb cash on cash return, and Airbnb occupancy rate. These are provided by Mashvisor’s investment property calculator.

Investment Property Calculator: Analysis of Airbnb Dallas Rental Property

Are you ready to start looking for the best Airbnb Dallas rental property to buy? Sign up for a 7-day free trial now followed by a 15% discount for life.