Computing rental income is never easy, as you need to factor in a lot of things. This is where an Airbnb pricing calculator comes in handy.

A short term rental property business can be quite lucrative if you know your priorities. At this point, it’s all about optimizing your investment. Let’s talk about how you can make the right calculations on potential rental properties that you can list on Airbnb.

Passive income, flexibility to sell at the right moment, and greater security. These are some of the excellent reasons why you’d decide to rent your property on Airbnb. Add diversification of investments and property value appreciation to the list.

Whether you’re thinking about investing in a rental property, hosting guests for some time, or putting your rental on Airbnb, the biggest question is, “How much money can I make with this type of investment?”

Using Airbnb to rent a property can be a profitable real estate investment strategy. But to run a successful Airbnb business, you need to find a way to set the right pricing, right? There must be a healthy balance to ensure that all the expenses are covered by the Airbnb income (which also allows you to scale the business when needed).

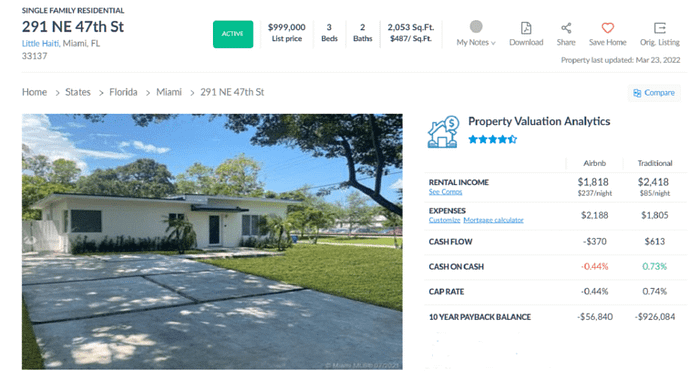

To set the price, you must determine what your space is worth. That’s where the Airbnb pricing calculator — like the one by Mashvisor — comes into play.

In this article, we will discuss what an Airbnb calculator is and how it can help you make better investment decisions, so you get optimum returns on your investment.

What Is a Good Airbnb Rental Property?

There is no universal answer to the above question or a definition that sums up everything in a few paragraphs. There are several important signs to look for, but assigning such a description is usually arbitrary.

To invest in a good Airbnb investment property is contingent on different factors. In the case of an Airbnb rental, everything must fall into the right place to reward you as a property owner or investor.

Before we proceed with defining the most important factors that make a good rental property, rental property investors might get caught up in something called analysis paralysis. Such a condition often prevents them from getting deals done.

Analysis paralysis is simply a condition or state of mind where you cannot make any final decisions because you went into overdrive mode in analyzing potential investment properties.

An investment property analysis should help you narrow down your options so you can pick the most suitable investment property that will help you achieve your goals. It should not, in any way, prevent you from deciding which property is best for you.

The essential elements of a good rental property and the signs you should be looking for include:

- Property condition

- Property value

- Property management

- Market trends (average rent, job market, and future development)

- Cash flow and growth potential

- Location (crime rate, nearby schools, taxes, and neighborhood)

Let’s take a better look at how an Airbnb income calculator can help you make crucial business decisions based on accurate data.

What Is an Airbnb Pricing Calculator?

An Airbnb pricing calculator is a tool real estate professionals use to determine a property’s profitability as an Airbnb rental. The tool calculates Airbnb income and sets reasonable nightly rates based on factors affecting the local market. The best Airbnb calculator will even lead you to investment properties with great income-generating potential.

There is no correct answer to what kind of profit you can make with Airbnb. According to iProperty Management, the average Airbnb host makes around $9,600 per year (while the earnings of top Airbnb hosts in the US can peak at $24,886 yearly).

Your earnings will vary according to factors such as maximum occupancy, the rental location, seasonality, and the number of rental properties you manage or own, among other things. To determine the potential return on investment, or ROI, on your property and whether it’s worth the investment, you can use an Airbnb pricing calculator.

How Does an Airbnb Pricing Calculator Work?

The first piece of data a pricing calculator relies on is the location of your property. The data used in the calculations are specific for particular markets across countries and regions. It ensures that the host always gets price calculations applicable to their particular market.

With a good pricing calculator in your hands, you’ll be able to determine the income potential for your new rental property. Also, it will help you come up with an Airbnb investment strategy that allows you to maximize its profitability. After you enter the address of your rental property and other essential data, the findings and estimates get delivered to you almost in real-time.

Advantages of Using an Airbnb Pricing Calculator

Mashvisor’s Airbnb pricing calculator can be a useful tool in understanding current and future real estate market trends.

As a rental property investor, there are several advantages to using an Airbnb calculator. They are the following:

1. You Can Compute Rental Expenses and Make the Necessary Adjustments

You cannot make money without investing some in the first place, so you need to create an accurate estimate of rental expenses. First, you’ll need these expense estimates so you can deduct them to reduce tax liability. Second, they are helpful when calculating the expected return on investment and cash flow.

Rental expenses that are available on Mashvisor’s Airbnb income calculator are —

- Startup expenses: Include inspections, total repair costs, closing costs, and furniture and appliances

- Ongoing monthly expenses: Include cleaning and maintenance fees, utilities, mortgage loan interest, repairs, Airbnb service fees, private mortgage insurance and property insurance, and marketing

Another good thing about using Mashvisor’s Airbnb estimator is that you can modify the already-provided expenses by adding custom ones (since some of your expenses may not be included there in the first place).

2. You can Easily Compare Airbnb Properties

Conducting a rental market analysis is another crucial step in determining the right price for renting out your listing. To do so, you will need to run an Airbnb rental comparison of properties in areas similar to where you own an Airbnb investment property or are considering buying one.

Learning more about the current and future real estate market conditions and trends is essential for the success of your Airbnb hosting endeavors. And the tool central to understanding such trends is your Airbnb profit calculator.

You can also use it to find out which locations are or will be most profitable for future investments.

You can perform the analysis manually by checking local rental listings to find rental properties comparable to yours in terms of type, size, and amenities. To save yourself some time, you can use Mashvisor’s Rental Property Calculator, which will automatically calculate your rental rate.

For those who plan to scale their Airbnb business in the next 3–5 years, the above information is crucial for staying competitive and making sure the tracked metrics will lead to profitability.

The metrics you will be able to calculate with an Airbnb calculator are —

Occupancy Rate

The occupancy rate shows the number of days during which a rental property is occupied by a guest. In other words, it’s the ratio of time in which a specific listing is rented as opposed to when it’s available for rent.

The factors that impact an Airbnb occupancy rate include guest reviews, seasonal changes, location, nightly rate, and marketing.

Cap (Capitalization) Rate

The capitalization rate shows the rate of return on investment you can get on your Airbnb rental property.

The cap rate is calculated by dividing the net operating income by your property asset value and then multiplying the result by 100. If your property’s capitalization rate is 10% or more, it is considered a good investment.

Cash on Cash Return

Cash on cash return is a metric that real estate investors use to evaluate a property’s current and future profitability. It is calculated by dividing the annual cash flow by the initial cash outlay and then multiplying the result by 100.

The rate is used to measure the net income produced by your property relative to the initial money investment made to buy the property. It is important when evaluating the potential profitability of a real estate investment deal.

You can also use cash on cash returns to compare different investment properties and get a consistent look at the long-term potential of different assets.

Rental Investment Financing Method

One important factor that will significantly impact your ROI and cash flow is your financing method. Our Airbnb price calculator includes a mortgage calculator that lets you see the size of the loan, down payment, and interest rate, which all affect your cash-on-cash return and cash flow.

Cash Flow

With a simple cash flow calculation, you can see the potential of rental property as an investment. You calculate it by subtracting property expenses from the rental income. A property worth investing in is one with a positive cash flow.

Potential Rental Income

The potential rental income is a metric that shows the amount you could earn from a listing.

To calculate long-term rentals, you should just multiply the monthly rent by 12. For Airbnb rentals, you should rely on your Airbnb price calculator because you need to factor in your estimated occupancy rate and pricing.

3. You can Find the Best Real Estate Properties to Invest in

First, you need to choose a top location. You want to find a location with a high occupancy rate — the fewer days per month your listing stays vacant, the more profit you’ll make. Look for cities that receive a large number of monthly visitors and where there’s a high Airbnb demand.

Second, you should choose the right type of property. For instance, if you decide to go to the center of a city packed with business travelers, buying a condo or small apartment makes the most sense. On the other hand, if you want to invest in a mountain or beach property to host friends or families on vacation, a single-family home is your best buy.

The type of property will significantly impact your rental income, occupancy rent, and, ultimately — your return on investment.

Regardless of your choice, you must conduct thorough market and neighborhood research before you invest. With an Airbnb calculator, you don’t need to do all that manually. Just enter the right parameters, and you will get the data you need (structured in an easily understandable format).

It makes Airbnb income calculators the perfect tools for finding rental properties.

Mashvisor’s Property Finder is an excellent tool Airbnb hosts can use to find the top-performing properties in the market of their interest.

How to Know If an Airbnb Pricing Calculator Is Accurate

A good Airbnb estimator will always give you highly accurate and realistic results. Ideally, the data that an Airbnb pricing calculator uses is pulled from Airbnb directly or other reliable sources like Redfin or MLS. The tools are the same ones that real estate investors use to get current rental market data.

An Airbnb profit calculator is a tool used by real estate experts when preparing reports because of its accuracy. Some of those tools — such as the MLS — are crucial to such an extent that they’re not allowed to be used by anyone outside the real estate industry. It makes an Airbnb pricing calculator a vital tool for Airbnb hosts.

That said, there are a lot of good Airbnb calculators available to you online, but not all of them offer the same level of accuracy. The results you obtain will largely depend on the quality of data the platform acquires.

As a result, not all of them will give you highly accurate and realistic results that translate well to your chosen market. A good Airbnb pricing calculator will always give you high-quality data and relevant information to give you market-appropriate results when analyzing properties.

What Makes Mashvisor’s Airbnb Pricing Calculator Special?

Mashvisor’s Airbnb calculator is one of the best available to investors and real estate professionals today. Its pricing calculator is the go-to tool for real estate investors and Airbnb hosts that can turn weeks of property research into a 15-minute endeavor.

Mashvisor pulls its data from highly reliable sources like Zillow, Realtor.com, the MLS, and Airbnb itself. It frequently updates its massive database to give you the latest vacation rental data you will need to make a realistic ROI projection.

The platform relies on predictive analytics and big data to deliver comprehensive real estate data. Its algorithms work to detect even the slightest change in local Airbnb demand, helping you set your pricing for maximum income.

In other words, the research process is amazingly simplified.

The real estate heatmap that comes with the calculator helps you pinpoint the neighborhoods and areas that match your criteria. All you need to do is type in the name of the city you want to purchase a property and browse neighborhoods to get information like the following:

- Median property prices

- Monthly long-term and short-term rental income

- Long-term and short-term rental cash on cash return

- Airbnb occupancy rate

With the above information at your fingertips, you will have everything you need to create a data-driven Airbnb investment strategy and outperform your rental market.

To get access to Mashvisor’s Airbnb calculator and other real estate investment tools, sign up for Mashvisor today.

Conclusion

The factors that determine how much you will make from renting out your property on Airbnb are numerous. You need to consider all variables, making manual calculations quite complex.

Once you set the pricing, it doesn’t mean you’re done monitoring it. Prices fluctuate, and you’ll want to keep track of them to ensure your business becomes and remains profitable.

The best real estate investment strategy is always backed by the right numbers. Conduct your research, pick the best property, and move ahead with your investment. For this reason, the tools you use in analyzing profitability and calculating your returns can make a difference in your bottom line.

Thanks to Mashvisor’s Airbnb pricing calculator, you will take a look at high-quality real estate data and use those numbers to devise the right pricing strategy. Turn a month’s worth of research and analysis into a 15-minute effort that lets you focus on other important aspects of the business — handling bookings, marketing, customer service, and guests.

Learn more about how Mashvisor can help you find the best deals in the most profitable markets by scheduling a demo now.