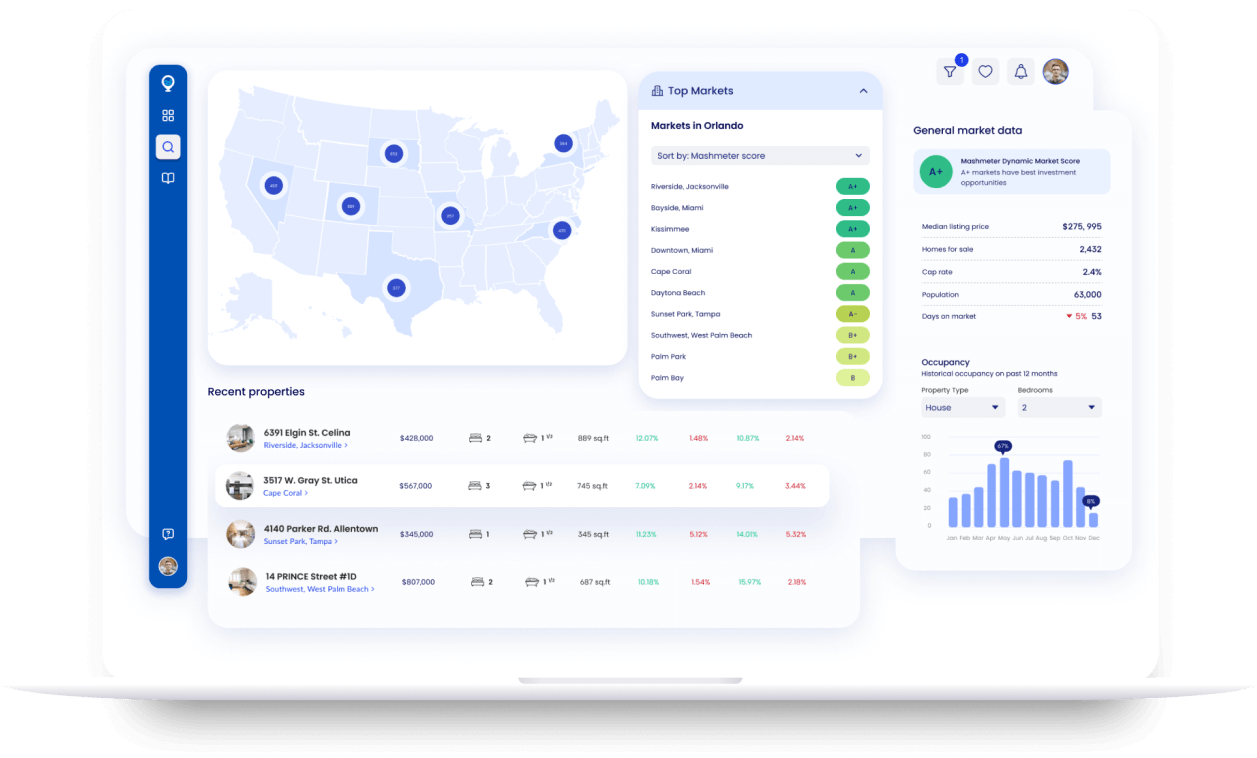

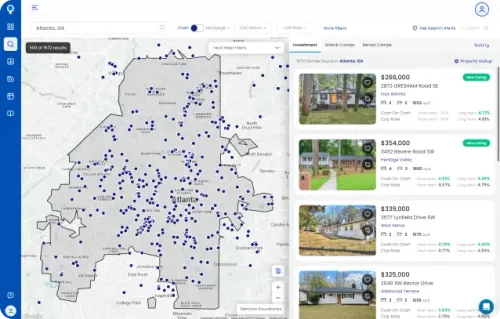

Accessible Real Estate Investing

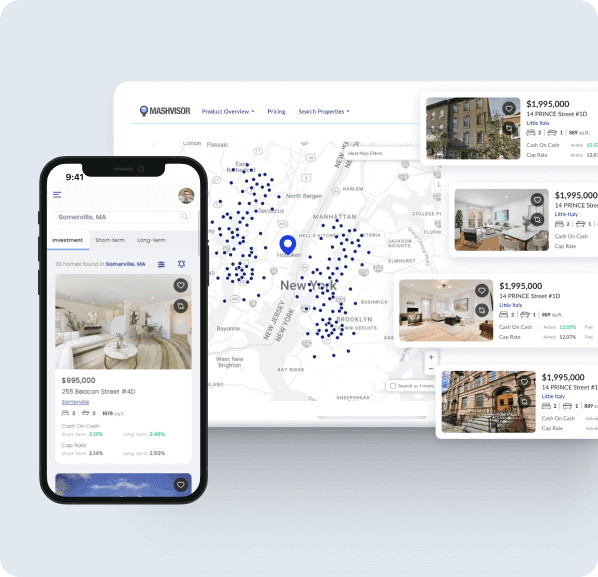

Get access to comprehensive real estate data that’ll help you conduct thorough rental analysis and identify lucrative investment opportunities. Mashvisor’s tools and features make real estate investing and Airbnb property management a breeze, even for beginners.

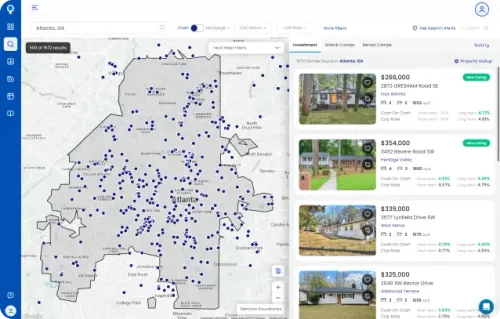

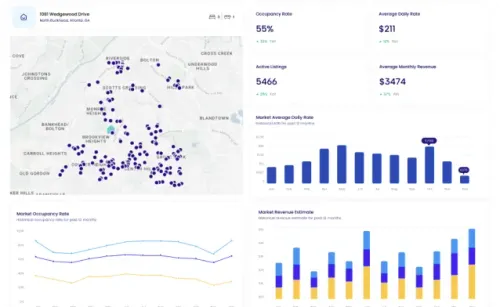

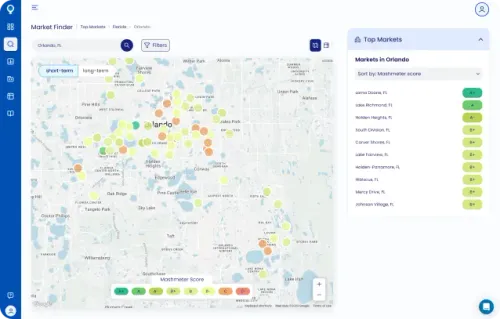

- Find the hottest markets nationwide for your chosen investment strategy with the Market Finder

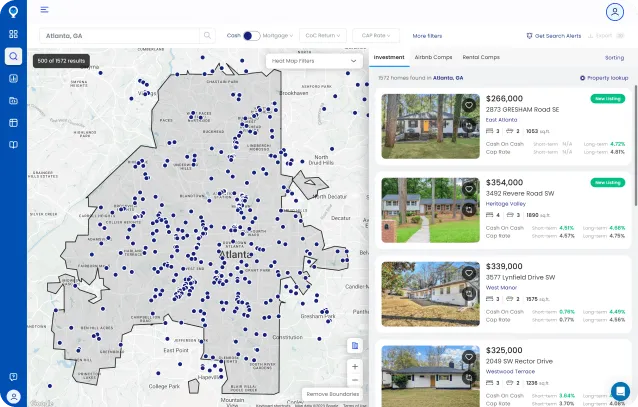

- Simultaneously search for the best property investment in up to five locations with the Property Finder

- Analyze a rental property investment’s profitability