Real estate investing is all about profit. A profitable investment property is considered a success, while a costly one is not. But what exactly is profit? A beginner real estate investor might think that rental income is the standard measurement for profit. The truth, however, is that there is much more than rental income that influences profit. All the factors of profit are combined in what is known as return on investment, or ROI for short. So, what is real estate return on investment? What is a realistic return on investment in real estate? We’ll tackle these topics in this blog post!

What Is Return on Investment?

First and foremost, what is real estate return on investment? Above all, ROI is a metric, or multiple metrics, used to determine the profitability of a rental property. It is superior to rental income in measuring profit because it includes a variety of factors. Some factors, such as operating and recurring financing costs, help to estimate the net profit of a property. Others, such as property price and total cash invested, help to evaluate the return on the cash paid for the real estate investment.

How Is Return on Investment Calculated?

So, how do you calculate ROI? There are three methods used. These include the standard ROI formula, cash on cash return, and cap rate. Each property metric has its unique purposes, and each is calculated differently.

-

Return on Investment

As previously mentioned, return on investment depends on several factors. The standard ROI formula depends on three: annual rental income (gain from investment), annual rental expenses (cost of investment), and the total cost of the investment. As a result, a standard return on investment forecast is calculated as:

As the name suggests, annual rental income is the amount of rent generated in a year. Annual rental expenses refer to the sum of costs used to maintain a rental property. However, these do not include financing expenses, such as mortgage payments. By subtracting rental expenses from income, real estate investors are left with cash flow. A positive cash flow is a net positive for income. A negative cash flow, on the other hand, is when expenses outweigh income- your rental property is costing you money. Finally, the cost of the investment refers to what you paid for the investment property.

-

Cash on Cash Return

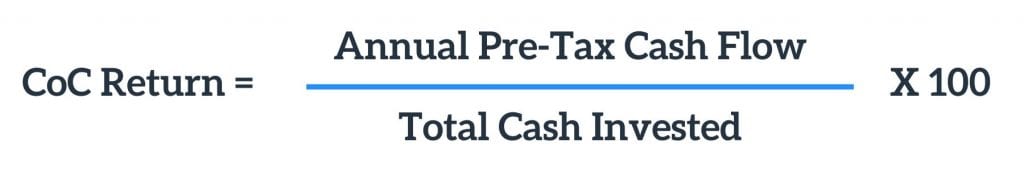

There is no doubt that the standard ROI formula is very useful. However, it excludes the financing costs of a property. To calculate a realistic return on investment, financing should be taken into consideration. Real estate investors, therefore, also turn to other ROI formulas, specifically the cash on cash return.

So, what is cash on cash return? Cash on cash return, or CoCR, is an ROI metric that takes the total amount of invested cash into account. It does so by including financing costs in its cash flow variable.

-

Cap Rate

The second ROI derivation is cap rate. Short for capitalization rate, cap rate is similar to CoCR. However, it measures profitability regardless of the financing method. This makes cap rate beneficial for rental property comparison. It depends on net operating income, the difference between income and operating expenses, and fair market value.

Related: Understanding Cap Rate vs. Cash on Cash Return

What Is the Average Return on Investment in the US Housing Market?

To better understand what is a realistic return on investment, it’s helpful to know what the average return on real estate is in the US housing market. According to the S&P 500 Index, the average return on investment in the US is 8.6%. The average varies based on the type of rental property. Residential rentals, for instance, have an average return on investment of 10.6%. REITs have an average ROI of 11.8%. Finally, commercial properties have an average return of 9.5%.

Find high return residential properties now anywhere in the US real estate market.

Related: Commercial vs. Residential Real Estate Investing: Which Is Best for 2020?

What Factors Influence Return on Investment?

Based on the averages mentioned, you might think that a realistic return on investment hovers around 10.6%. The reality, however, is that investing in real estate for ROI is affected by a variety of factors.

What is the most important thing when investing in rental property? Location, location, location! You might have heard this a million times, but it’s only because it’s so true. The range of a realistic and good return on investment varies based on location. Big cities, for instance, usually have lower ROI ranges compared to rural and suburban areas. Rental types and strategies also impact realistic return on investment expectations. Apartment complexes, for example, typically have higher ROI than single-family homes. In addition, an Airbnb rental strategy is more profitable than the average traditional strategy.

Estimate the potential Airbnb rental income of your property using our free Airbnb calculator.

What Is a Realistic Return on Investment in Real Estate?

With all that being said, what is a realistic return on investment in real estate? The truth is there is no end-all-be-all answer. Due to many factors playing a role, there is no universal standard for what is a realistic return on investment. In the realm of comparison, buying income property is a local business endeavor. A 3% ROI for an Airbnb rental in Palm Springs is not exactly comparable to a 12% ROI single-family rental in Cleveland. Ultimately, you need to find out what a realistic ROI is based on your location, rental type, and rental strategy.

Related: 5 Characteristics of the Best Places to Invest in Real Estate

So, How Can You Find Realistic Return on Investment Estimations?

This begs a question, however. How can you find realistic return on investment forecasts based on the 3 main factors? Fortunately, there is a definitive answer to this question: use a real estate investment calculator. Mashvisor’s rental property calculator is the ultimate real estate analysis tool. It provides reliable ROI estimations for residential rental property in the US housing market. Backed by predictive analytics, the calculator also tells investors the optimal rental strategy of a property. The calculator is also interactive, allowing real estate investors to adjust for their own financing, investment, and profit goals.

To search for properties with a 20% return on investment, CLICK HERE to start your FREE trial with Mashvisor!