If you are anywhere close to the world of real estate investing, you must have heard of all the new rules and regulations which short term rental properties face in more and more US markets. This might be making you wonder whether buying an Airbnb investment property is still a good real estate strategy in 2020. The short answer is “YES, ABSOLUTELY!” To invest in Airbnb remains one of the leading real estate investment strategies in 2020 for the many benefits which it offers over traditional rental property investing.

In this article we will show you why you should invest in Airbnb for sale and what the best places for this rental strategy are in 2020.

Why You Should Invest in Airbnb for Sale in 2020

The advantages of making an Airbnb investment in 2020 are numerous. Here’s a list of the major ones:

1. Owning a Second Home

Buying an Airbnb income property is not simply purchasing an investment property but also buying a vacation home. As an Airbnb host, you can choose which days to have your property available for guests and which days to keep it reserved for you, your family, and your friends. This means that you get to spend your holidays in your favorite location, at the comfort of your phone, without spending a ton of money on hotels. That’s something you cannot do with long term rentals as traditional leasing agreements last from a month to a year.

2. Enjoying a High Degree of Flexibility

When you invest in Airbnb for sale, you get a significantly higher level of flexibility than when buying an investment property to rent out on a long term basis. As mentioned above, you choose when to have your vacation home available for guests and when for yourself. Moreover, because an Airbnb income property gets rented out on a daily basis, you can adjust the nightly rate to match demand from Airbnb guests in the local real estate market. You can ask for a higher Airbnb daily rate in the high season (plus weekends and popular events) to optimize your return on investment in terms of cash on cash return and cap rate. Alternatively, you can offer a lower Airbnb pricing structure during the low season to enhance your Airbnb occupancy rate. The Airbnb platform and other home-sharing websites also give you the opportunity to screen guests by providing you with reviews from previous hosts. This means that you can make an informed decision on whom to let into your vacation home. Ultimately, as an Airbnb host, you are much more in control of your income property and investment strategy than as a traditional landlord.

3. Generating a Higher Return on Investment

This is the most important reason why you should invest in Airbnb for sale in 2020. After all, the goal of all real estate investors is to make money – the more, the better. According to nationwide rental market analysis conducted by Mashvisor’s real estate investment software tools, in the vast majority of US housing markets buying an Airbnb income property yields a significantly higher cash on cash return and cap rate than investing in traditional rental properties for sale. The explanation is simple – the daily rate of a short term rental is considerably more than the daily rate of a long term rental where rent is paid on a monthly basis. Furthermore, as highlighted above, with the Airbnb investment strategy you can easily optimize your Airbnb pricing strategy, making sure it’s always up to date.

4. Having Access to Tax Benefits

Another reason to invest in Airbnb rental properties in 2020 – directly related to the higher rate of return – comprises of the tax deductions available to owners of vacation homes. Depending on the number of days for which you rent out your property and the number of days for which you use it for personal reasons, you can claim various degrees of tax deductions. This is in addition to all the other tax benefits which you enjoy from the fact that you own an investment property which is equivalent to running a business. For example, such recurring expenses as transportation to your rental property, office space, office supplies, and many others are tax deductible. As a smart real estate investor and Airbnb host, you should take advantage of every opportunity to minimize your monthly costs, increase your cash flow, and maximize your return on investment – as both Airbnb cash on cash return and Airbnb cap rate.

5. Making Passive Rental Income

Erroneously many assume that to invest in Airbnb for sale equals becoming an Airbnb host. This can definitely be the case if you are excited to meet people from all around the US and the globe, to clean your Airbnb income property after guests and prepare it for the next ones, and to generally be actively involved in your short term rental property management. However, if that doesn’t like the right type of business for you, there is an easy alternative solution. More and more vacation home rental property owners choose to hire a professional property manager to take care of all aspects of owning, managing, and renting out an Airbnb investment property. This means that Airbnb investing has joined the list of passive real estate investment strategies, which constitutes an important benefit for busy investors.

6. Facing Unlimited Options

Despite all newly emerging Airbnb laws and regulations, there are still numerous US real estate markets where non-owner occupied short term rental properties are legal for an unrestrained number of days per year. A few prominent examples which offer a high return on investment for investors include such major cities as Airbnb Dallas and Airbnb Atlanta as well as smaller towns such as Huntington, VT and Tuscaloosa, AL. Moreover, in each of these markets real estate investors can select from investment properties for sale from various types (single family homes, condos, townhouses, multi family homes, etc.), with different numbers of bedrooms and bathrooms, and within varying budgets. The US housing market is so diverse that it can meet the needs and expectations of everyone who decides to invest in Airbnb for sale.

7. Analyzing Airbnb Rental Properties for Sale More Easily Than Ever Before

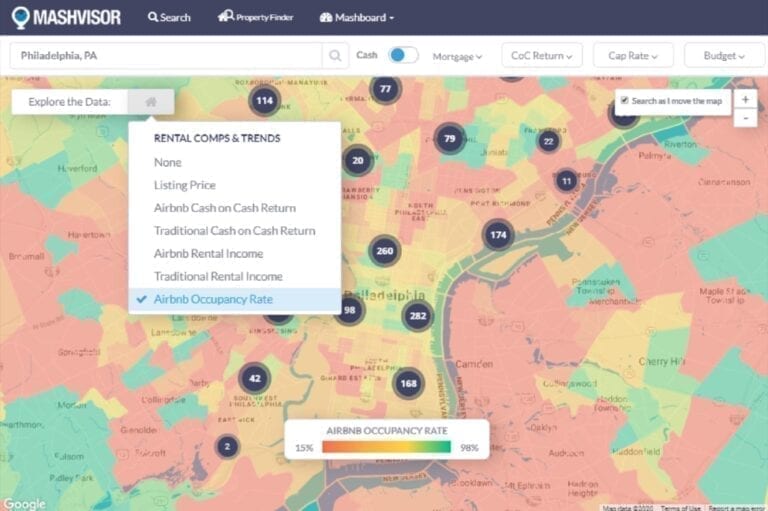

Experts agree that the real estate market analysis necessary to make an informed, profitable rental property investment decision requires 3 months of data gathering and calculations. This is no longer the case. With the help of a real estate investment app like Mashvisor, even first-time investors can find a top-performing Airbnb investment property in a matter of minutes. Mashvisor’s heatmap tool highlights the neighborhoods of any US city and town that constitute the best locations for buying an Airbnb income property in terms of:

- High Airbnb occupancy rate

- High Airbnb rental income

- High Airbnb cash on cash return

- Low property prices

Mashvisor’s Heatmap: Airbnb Occupancy Rate in the Philadelphia Real Estate Market

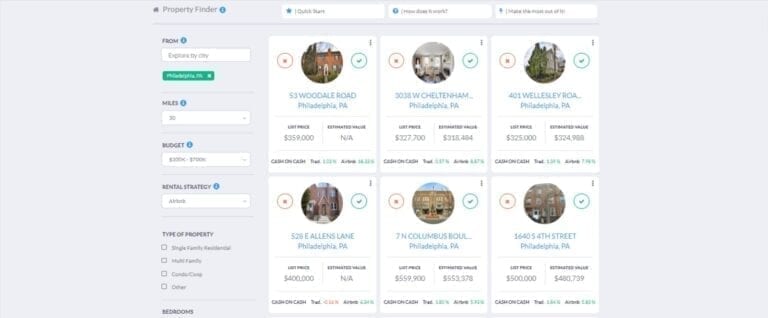

Another real estate investing tool developed by Mashvisor – the Property Finder – points investors in the direction of the rental properties for sale which meet their criteria (such as location, budget, property type, etc.) and which offer the highest Airbnb cash on cash return.

Mashvisor’s Property Finder

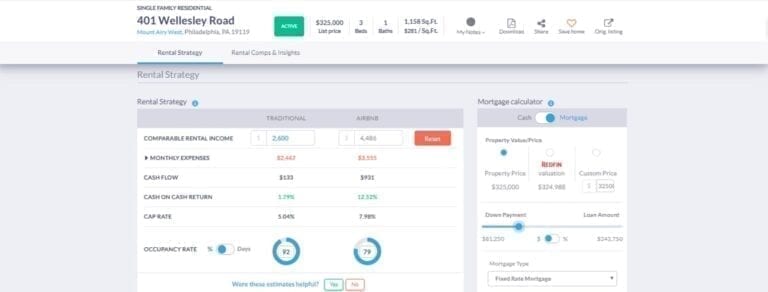

Once an investor has identified a few profitable income properties for sale, he/she can conduct detailed rental property analysis with Mashvisor’s investment property calculator, yet another real estate investment software tool. For each property listed on the platform as well as for any other property which an investor enters, Mashvisor will conduct the needed analysis and provide:

- One-time startup costs

- Recurring monthly expenses

- Airbnb rental income

- Airbnb occupancy rate

- Cash flow

- Airbnb cash on cash return

- Airbnb cap rate

Mashvisor’s Investment Property Analysis

Importantly, Mashvisor gets its Airbnb data from the home-sharing platform directly, which means that all neighborhood analysis and investment property analysis is based on the performance of actual short term rental listings in the area.

What You Should Keep in Mind When Buying an Airbnb Investment Property

Now that you have become familiar with all the most important benefits of investing in Airbnb for sale in 2020, it’s time to learn a few things you should keep in mind before moving forward. Similar to all other real estate investment strategies, to invest in Airbnb also comes with a few drawbacks.

1. A Lot of Hard Work

First and foremost, becoming an Airbnb host requires a lot of time, effort, and energy. You have to create an outstanding listing to enhance your Airbnb occupancy rate; to set the right prices; to communicate with potential guests; to clean and restock your vacation home; to welcome Airbnb guests; and to be always available to address any urgent matters and issues.

2. Professional Property Management = Less Control

We have already mentioned that you can go around the above-listed challenge of investing in Airbnb for sale by hiring a professional property management company to take care of your income property. However, this also comes at a price: namely, you lose a significant portion of the control over your rental property. Some investors though prefer to be fully in charge and hands-on.

3. Airbnb Laws and Regulations

Last but not least, we come back to the fact that investing in Airbnb income properties for sale is facing more and more regulations and restrictions in many major US cities. Such US housing market trends are likely to continue throughout 2020 and beyond. Before deciding on a real estate market where to invest in Airbnb, you should study carefully and meticulously the local short term rentals regulations to assure that buying an investment property for the sole purpose of renting it on Airbnb is legal.

The Top Locations for Investing in Short Term Rental Properties in 2020

To help out beginner real estate investors who would like to make money as Airbnb hosts in 2020 but have no idea where to start, we’ve put together a list of the best places to invest in Airbnb for sale for a high return on investment. This list is based on Mashvisor’s nationwide real estate market analysis.

1. Springfield, MO

- Airbnb Cash on Cash Return: 5.7%

- Airbnb Daily Rate: $91

- Airbnb Rental Income: $2,110

- Airbnb Occupancy Rate: 51.1%

- Median Property Price: $216,800

2. Tuscaloosa, AL

- Airbnb Cash on Cash Return: 5.4%

- Airbnb Daily Rate: $480

- Airbnb Rental Income: $3,080

- Airbnb Occupancy Rate: 32.6%

- Median Property Price: $424,500

3. Gatlinburg, TN

- Airbnb Cash on Cash Return: 4.5%

- Airbnb Daily Rate: $179

- Airbnb Rental Income: $3,270

- Airbnb Occupancy Rate: 64.4%

- Median Property Price: $449,300

4. Marana, AZ

- Airbnb Cash on Cash Return: 4.5%

- Airbnb Daily Rate: $202

- Airbnb Rental Income: $3,100

- Airbnb Occupancy Rate: 52.5%

- Median Property Price: $372,100

5. Sevierville, TN

- Airbnb Cash on Cash Return: 4.2%

- Airbnb Daily Rate: $176

- Airbnb Rental Income: $2,870

- Airbnb Occupancy Rate: 60.1%

- Median Property Price: $409,400

All in all, regardless of all legal issues and challenges, to invest in Airbnb investment properties for sale remains on top of the best real estate investment strategies in 2020.

Now that you know what considerations to keep in mind when buying an Airbnb for sale property, all that’s left is to sign up with Mashvisor today to start making money with your short term rental property.