The short term rental market remains strong. To find a profitable market, you need to conduct a thorough short term rental analysis.

This year, despite the possible recession and mild housing crash, Airbnb real estate investing continues to grow in popularity. In fact, real estate experts believe that the short term rental market will remain strong as more people understand its profit potential. The demand for vacation rentals will grow continuously as people are still eager to travel and beyond.

Table of Contents

- Step 1: Look for a Good Area to Invest in

- Step 2: Evaluate the Airbnb Rules in Your Preferred City

- Step 3: Locate a Good Neighborhood

- Step 4: Estimate Your Potential ROI

Generally speaking, short term real estate investing pays out nicely. Unfortunately, not every property is optimal for a short term rental investment strategy. It’s crucial to buy vacation rental property that can help you achieve your goals. When investing in short term rentals, the right location is vital. So, how can you find a lucrative short term rental investment?

Investors frequently undertake a thorough short term rental analysis to locate profitable vacation homes. The best short term rental markets will likely provide the highest profit potential for your investment. However, there are several things to consider when finding the right market for your vacation rental investment.

Finding the best investment property can be time-consuming and stressful. But with the right tools, you can now perform short term rental analytics in minutes. Mashvisor provides the necessary tools and data that can help investors find profitable deals. Mashvisor’s short term rental data and analytics can help you make better investing selections.

In this article, we’ll go over the steps needed to do a complete short term rental analysis.

How to Analyze a Short Term Rental

Follow the steps below when analyzing a short term rental:

Step 1: Look for a Good Area to Invest in

Finding a decent city to invest in is the first stage in performing a short term rental analysis. When it comes to real estate investing, location is everything. Regarding investing in short term rentals, it is even more important. Before you buy any vacation homes for sale, you must first choose the ideal city.

What are the qualities of a good location for short term rental investing? Many factors come into play. Make sure to consider them when choosing the right short term rental market:

Strong Economy and Tourism Industry

Generally, a city with a robust economy and tourism is an excellent place to invest in a short term rental property. It is because the success of vacation rental homes is heavily reliant on tourism. The best place for investing in short term rentals are those that are close to several tourist attractions.

Aiming to invest in an area that provides easy and quick access to the city’s major tourist attractions and other locations is a wise idea. Since short term rentals are seasonal, you should be able to mitigate such a risk by ensuring that the place where you invest offers a lot all year round.

Amenities, Recreational Facilities, and Overall Safety

Keep in mind that you might not be able to rent rooms during off-peak times if tourists only come during peak holiday seasons. That’s why choosing a place with plenty of amenities and recreational activities is a great idea. A solid public transit system, shopping complexes, parks, outdoor activities, and other vital facilities should be available in the city where you invest.

In addition, you want to ensure that the area where you invest is generally safe for your guests. While buying an Airbnb investment property located on a busy street can attract tourists, you also have to consider the safety of the location. Overall safety is essential if you want your property to get a high occupancy rate.

Popularity and Occupancy Rate

When you think about the cities’ seasonality trends and average occupancy rates on home-sharing platforms, you should also consider how many people stay there each month. The more popular the location is to tourists, the higher the occupancy rate will be. Remember that the occupancy rate can significantly affect your profitability as a short term rental owner.

If you want to find a city where you can make a lot of money through short term rental investment, it’s important to conduct a thorough short term rental analysis. It lets you understand the market more, including the renters’ demands, your potential profit, and the possible competition in the area.

Step 2: Evaluate the Short Term Rental Rules in Your Preferred City

When you perform a short term rental analysis, you need to look at short term rental rules in your city. Depending on where you plan to invest, the rules for renting out a property as a short term rental can be very different. It’s important to know the rules and regulations specific to where your vacation rental property is located to avoid getting into trouble later on.

Note that there might also be a few guidelines that may not be acceptable to all short term rental guests. Therefore, it is necessary to review the city’s ordinances and regulations on short term rentals. As an investor, it’s crucial to know how the rules will affect you and your profitability. Staying in compliance with the law will prevent you from having to paying hefty fines.

Several towns have very strict rules regarding operating a short term rental business. In fact, some cities do not allow the operation of short term rentals. For example, San Francisco and Las Vegas are two cities that have very strict rules against the short term rental business.

Before you start searching for the best Airbnb investment opportunities, check with your local town council to see what rules are in place for Airbnb. Then, to run a successful business, look for cities with the most lenient rules for short term rentals.

Cities With the Strictest Short Term Rental Regulations

As mentioned, different cities may have different short term rental regulations. When choosing a location for your short term rental investment, it’s important to determine which cities have lenient short term rental rules, and which ones have strict regulations. Make sure to avoid cities with very strict laws when it comes to operating a short term rental business.

Here are the three cities with the strictest short term rental rules:

New York City, NY

While New York is one of the biggest tourist destinations in the United States, it also has one of the strictest short term rental regulations that vacation rental owners should be aware of. Failing to abide by the law can result in expensive penalties. The multiple dwelling law in New York City prohibits the renting out of an unhosted property with three or more units for less than 30 days.

On the other hand, a single family home may be subjected to zoning restrictions. It means you need to meet certain building codes to be eligible for rental. Also, New York short term rental owners should only have two paying guests staying in the property for less than 30 days. On top of that, guests must have access to all rooms and exits, so hosts are not allowed to install locks.

San Francisco, CA

To host a short term rental in San Francisco, you need to register your business and obtain a valid Short Term Residential Rental Certificate. The catch is that you can only register your listing if you live at the property for a minimum of 275 days per year.

You can rent out a spare room in your house for an unlimited number of nights as long as you stay at the property while your guests are there. If you choose to rent out your entire space without your presence, you may do so for a maximum of 90 days per year only. Plus, you’ll be required to pay a 14% transient occupancy tax on short term reservations of less than 30 nights.

Las Vegas, NV

In Las Vegas, non-owner occupied short term rentals are banned. To operate a short term rental business, you must obtain a business license and take out liability insurance of $500,000. Also, you need to renew your rental permit every six months, or else, you will be penalized.

What’s more, your property should not have more than three bedrooms and it must be at least 660 feet away from other short term rentals. Plus, there is a maximum occupancy limit of two adults per room. In addition, you are not allowed to rent out your short term rental for weddings and other parties or events.

To know more about short term rental rules and regulations, visit Mashvisor’s short term rental regulations page.

Step 3: Locate a Good Neighborhood

The specific neighborhood where you invest is also crucial to your success as a short term rental property investor. Before you choose a neighborhood to invest in, make sure to conduct proper analysis of the area to ensure that it is optimal for short term rentals. There are several qualities that make a neighborhood ideal for investing in vacation rentals, such as:

Safety

A good neighborhood should be safe. As a short term rental property owner, you should ensure that your guests are safe and secure while they are staying at your place. Before buying an investment property, be sure to check the crime rate in your chosen neighborhood. Also, it’s important to visit the area personally so you can assess the situation properly.

Some major red flags include isolated neighborhoods where most houses are unoccupied or abandoned. If businesses within the vicinity have closed, it might also be an indication that the area is not good for investing. Also, be wary of suspicious bystanders within the area.

Amenities

When choosing a neighborhood to invest in, it’s important to consider what amenities your guests would need. In general, tourists would want to stay at a place where it is easy for them to access different transportation options. Local businesses around, including restaurants, shopping centers, and marketplaces, and recreational facilities like parks, are also a plus.

Short Term Rental Demand

The best place to buy rental property to be listed on home-sharing platforms should have sufficient demand for short term rentals. However, it’s quite challenging to study the market and conduct your own analysis to check its profitability. In the past, investors used a spreadsheet when analyzing rental comps to determine a neighborhood’s potential rental demand.

Fortunately, with the availability of advanced technology, performing short term rental analysis is now made easier. You don’t need to manually input the real estate data on a spreadsheet before you can make an analysis. Investors use real estate platforms like Mashvisor to conduct an Airbnb data analysis when trying to find the best neighborhoods for short term rentals.

Mashvisor offers several real estate tools to help you find a good neighborhood that is optimal for buying an Airbnb investment property. With Mashvisor, you can access the important tools and services that can help with your short term rental analysis.

Related: Mashvisor Reviews: What Do Investors Think of This Real Estate Platform?

Using a Heatmap Tool

Neighborhoods in the same town usually offer different investment opportunities. If you want to choose the right area, you need to know your target audience and what they expect to see. For example, people who stay at short term rentals are primarily tourists. When they visit, they want to be close to popular attractions, like urban areas, play parks, or recreation centers.

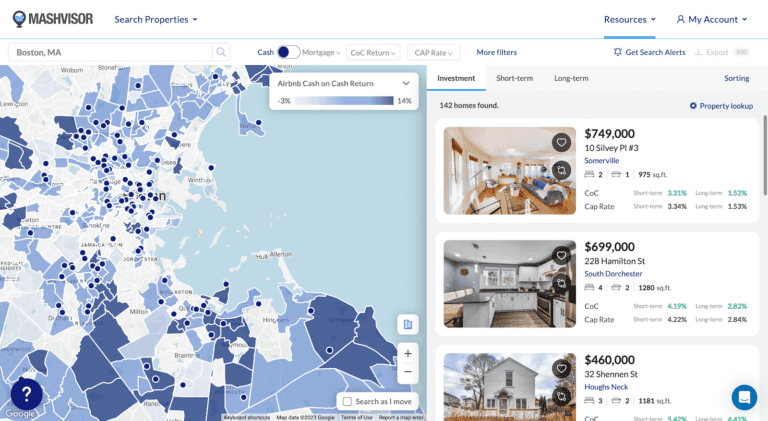

Mashvisor’s heatmap analysis tool

Short term rental market analysis can help you find the best places to invest in vacation rentals. Using Mashvisor’s heatmap tool, you can choose the best neighborhoods by using the right filters according to your preference. Such filters include the price of the listing, cap rate, the amount of short term rental income, and the number of people who stay in a vacation rental.

Find the Best Place to Invest in Airbnb

To find the best short term rental investment property, you need to find a lucrative market and a neighborhood with reasonable short term rental rules. Make sure that the investment property will be profitable. Keep in mind that even with a good rental market, not all properties located in that market will make a good investment.

As an investor, it’s essential to ensure that when buying an investment property, you should get a good return on investment when you list that property on home-sharing platforms like Airbnb. Generally, finding the best investment property for short term rentals can be hard. But with Mashvisor’s Property Finder tool, you’ll have access to the property’s short term rental analysis.

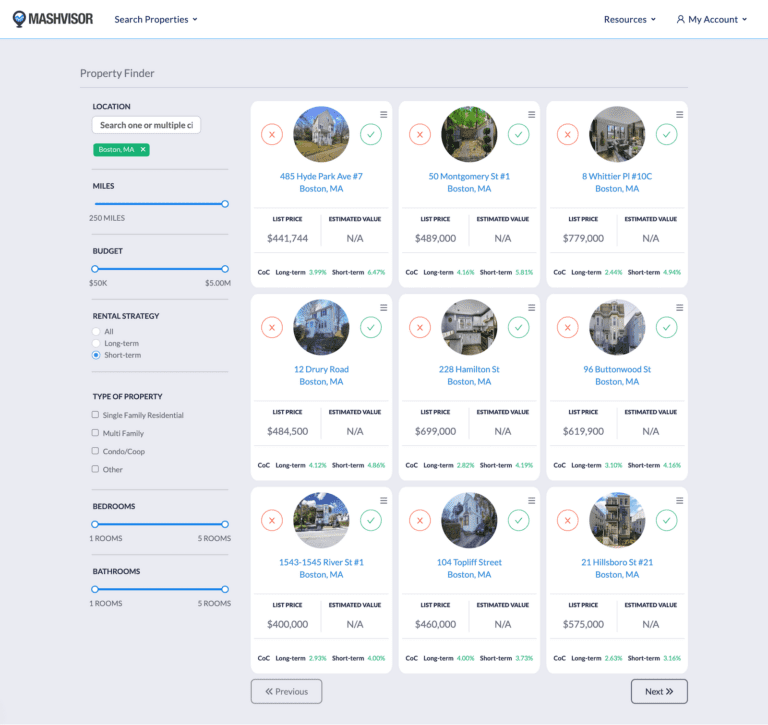

Mashvisor’s Property Finder

You can use the Property Finder to search for a property to rent on home-sharing platforms. The tool lets you search for income properties that meet your needs and criteria. For example, if you already know which city you want to invest in, you can use the tool to find vacation rental properties that are doing well in the area based on cash on cash return.

Then, it will generate a list of results based on your preferred filters, like budget, size, property type, and rental strategy. Afterward, you can choose the property that interests you, and you’ll see the Airbnb data and analysis that can help you make the right decision.

Analyze the Property Using the Investment Property Calculator

After you find a property that interests you, you can conduct an Airbnb analysis and use the Airbnb calculator to compute your potential profits. The tool, also known as the investment property calculator, can help you figure out how much money you can make out of the short term rental property.

Use Mashvisor’s Property Finder to find the most excellent Airbnb investment property for you right now.

Step 4: Estimate Your Potential ROI

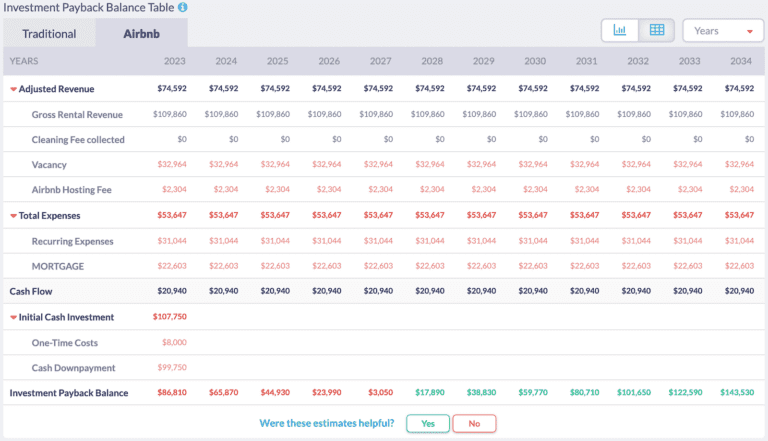

Mashvisor’s Investment Payback Balance

The rental investment calculator provides all the necessary figures that you’ll need to determine a property’s profitability. They include the cap rate, cash on cash return, occupancy rate, monthly rental income, and expected expenses. This real estate investor calculator eliminates the need for a spreadsheet to compute the important figures, minimizing the risk of errors.

If you use Mashvisor’s investment property calculator, it looks at the most up-to-date data and trends to come up with its estimates. The tool calculates the property’s return on investment (ROI) metrics using the provided information about the property.

What’s more, you can customize some figures, too, allowing you to get a more accurate and personalized result. For instance, you can set your own financing information, such as the amount of the down payment, the interest rate, and mortgage terms. You can also add to the expenses if you plan to spend for the improvement of the property.

Calculating the ROI, especially the cash on cash return, is very dependent on the costs of financing the property. Mashvisor’s rental income calculator lets people choose whether they want to use cash or a mortgage to pay for their homes. For mortgages, real estate investors need to put in the amount of the down payment, the interest rate, and the loan amount.

Related: What Is a Good Return on Investment for a Rental Property?

One-time Start-up Costs and Monthly Expenses

To calculate rental ROI, the calculator needs to know the financing costs for acquiring the property. With Mashvisor’s calculator, the figures for expenses are already provided, making it easier to get an accurate computation compared to using a spreadsheet.

Mashvisor’s investment property return calculator gives you expense estimates based on real estate comparables and where the property is located. Rental property costs include one-time start-up costs and recurring monthly expenses.

Start-up costs are only paid once, usually when you acquire the property. Some of the fees are for furnishing and closing costs, as well as for property inspection. Recurring expenses, on the other hand, stay the same on a monthly basis. They include HOA dues, income tax, insurance, and a lot more.

The rental property calculator lets you leave the estimates the way they are, or you can edit them and add your own so you can get a more accurate result.

Rental Property Financing Expenses to Keep in Mind

Here are a few expenses to consider when managing a rental property:

Upfront Costs

- Appraisal fee – To figure out how much money you can give for a mortgage, the lender needs proof that the investment property is valuable. They do it by having you get an appraisal. The cost is around $300 for a single family home and $600 for a multifamily house.

- Home inspection – It is in your best interest to get a home inspection before you purchase a rental home to make sure it is in the condition it is promoted. Costs are about $200 to $500.

- Closing costs – These are the costs of buying the house legally, like applying for a mortgage, getting it recorded, and so on. They cost between 2% and 5% of the home price.

Monthly Expenses

The following are the costs associated with owning a rental property:

- Mortgage payments and property taxes

- Insurance

- HOA dues

- Rental income tax

- Permits or licenses

- Property management fees

- Property maintenance

- Utilities

- Cleaning fees

- Upgrades and emergency budget

- Vacancy costs

Let’s now look at how to figure out the costs of rental property expenses. Of course, it’s not easy to know everything about a deal before you start investing in real estate. But you can use the numbers and percentages to see how much money you could make by investing in the property.

When you’re done with the above, it’s time to look into the market. How much does it cost in this area when it comes to cleaning? How much do similar rental properties charge for electricity and gas?

Bank websites can help you figure out how much money you’ll need to pay for your rental home’s mortgage and insurance. It will help you determine how much it will cost in full. For a fully informed decision, you should use a very precise tool, not just the old spreadsheet method.

Again, this is where you can let go of all of the manual work and calculations you would normally do yourself. Mashvisor’s rental property calculator does all of it for you. By eliminating the need for spreadsheet use, Mashvisor’s investment calculator lets you come up with accurate figures. It will help you make better investment decisions.

Return On Investment

The short term rental analytics continues with the property’s return on investment (calculated after all the data is put in). The calculator looks at ROI in three ways. They are cash flow,the cap rate, and cash on cash return.

Cash Flow

Cash flow refers to the amount of money that goes in and out of your business. As an investor, you should aim for a positive cash flow property. It means that you will have cash remaining after all the expenses are deducted from your income. A positive cash flow property means it is profitable.

On the other hand, if your expenses are higher than the amount of cash you receive, you will likely end up having a negative cash flow. It means that you spend more than what you earn, forcing you to use money out of pocket to sustain the business. When performing a short term rental analysis, the cash flow metric is crucial to determine an investment’s profitability.

Cap Rate

When you use Mashvisor’s calculator for your short term vacation rental analysis, you’ll get the most accurate and comprehensive ROI analysis out there. In fact, the tool also acts as a cap rate calculator. It provides you with specific real estate data on the cap rate to know the property’s potential returns.

Cap rate is the rate of return used to determine a property’s profitability based on the property’s current market value or purchase price. It’s worth noting that cap rate calculations do not consider the method of financing used, as it is only based on the property’s value. Ideally, a good cap rate is around 8% or higher. However, the figure depends on the location of the property.

In some cases, especially if the property is located in an area with high appreciation rates, cap rates of at least 2% are considered a good investment. Performing a market analysis should always include the calculation of the cap rate. It is an important metric to determine whether or not a property would make a worthwhile investment.

Cash on Cash Return

The cash on cash return is similar to the cap rate in many ways, except that it takes into consideration the method of financing used for acquiring the property. It only computes the property’s profit potential based on the actual amount of cash you initially invested.

It includes the amount of your down payment, closing costs, and other expenses you paid in cash (not a loan). Similar to the cap rate, the ideal cash on cash return is around 8% or higher. However, it can also vary depending on the location. Typically, locations with higher appreciation rates tend to have a lower cash on cash return.

Taking this into account, a cash on cash return of at least 2% is considered good.

In addition, Mashvisor’s short term rental income calculator comes with a lot of unique features, such as the following:

- Optimal rental strategy

- Real estate comps

- Investment payback balance

- Property income

If you’re on your way to conducting the optimal rental strategy, you should try Mashvisor’s Airbnb calculator.

Should You Use a Spreadsheet to Analyze Short Term Rentals?

Traditionally, investors used a spreadsheet when conducting a short term rental analysis to create their rental estimate. Using a spreadsheet is a manual way of calculating your potential returns for a particular investment property. It is generally prone to error because you need to research the real estate data and input them manually on the spreadsheet.

Nowadays, using a spreadsheet is no longer in fashion. The availability of a short term rental investment calculator makes the analytics process so much easier. You can use a rental analysis calculator to get more accurate results. As mentioned, the best investment property calculator available is Mashvisor’s rental property calculator.

What Is Mashvisor’s Rental Property Calculator?

Mashvisor’s rental property calculator calculates the cash flow that a property can generate. It helps extract rental pricing and costs from rental comps and provides a breakdown for both short term and long term investing. It allows you to compare both investment strategies side by side to see which is best for your chosen investment property.

The cash flow varies significantly, depending on the local home market, charges, utility bills, and additional short term rental expenditures, among other factors. As a result, some areas are superior for short term rental investments than others for long term rentals.

When it comes to short term rental analysis, the above given is just one aspect of Mashvisor’s investment property calculator tool. It allows you to compare and evaluate rental homes for sale by price, estimated rental income, cap rate, rate of return, and even occupancy rate.

Plus, you can add a property to examine its specs or explore Mashvisor’s database using particular criteria. It’s simple to anticipate future spending and find positive cash flow properties because of the data Mashvisor provides.

Conclusion

Short term rentals are among the best investment strategies to consider this year. You’ll need to undertake a thorough short term rental analysis to find the top short term rental investments on the market. In addition, you must choose the best city, location, and vacation rental property while completing a short term rental market study.

If you’re looking for the best short term rental analytics platform, look no further than Mashvisor. The platform provides several tools that can help you perform a thorough analysis and find the best property to invest in.

The primary tools you’ll need for short term rental strategy analysis are Mashvisor’s heatmap analysis tool, Property Finder, and short term profit calculator. In a matter of minutes, they can assist you in analyzing vacation investment homes. Furthermore, before you invest, make sure to research the city’s short term rental policies to ensure that you’re investing in the right place.

Are you ready to experience what Mashvisor tools can offer? Schedule a demo now.